Continuous Disclosure and Updates

Cromwell Riverpark Trust

Continuous Disclosure and Updates

Cromwell Riverpark Trust

Continuous Disclosure and Updates

Cromwell follows ASIC’s good practice guidance for website disclosure of material information. This means that all material information in relation to the Cromwell Riverpark Trust will be posted on this webpage as soon as practicable after Cromwell becomes aware of it.

A new external valuation has been obtained for Energex House, Newstead, as at 31 May 2025.

The property’s valuation remains unchanged from the 30 June 2024 valuation at $270 million. The capitalisation rate has softened by 25 basis points to 7.00%.

The asset remains 100% occupied, with a weighted average lease expiry of 5.0 years.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Download the latest Cromwell Riverpark Trust Disclosure Guide here.

Cromwell Funds Management Limited has simultaneously terminated Cromwell Riverpark Trust’s (Trust) existing interest rate hedging and entered into a new $120 million interest rate hedge.

The Trust is now 94.5% hedged (based on drawn balance) for 2 years.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS), the supplementary product disclosure statement dated 30 June 2009 (SPDS) and the Notice of Meeting and Explanatory Memorandum dated 30 October 2024 (NOMEM). The PDS, SPDS and NOMEM are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS, SPDS and NOMEM and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Cromwell Riverpark Trust (“Trust”) unitholders have voted to approve the Term Extension Proposal for the Trust, as put forward in the Notice of Meeting and Explanatory Memorandum, dated 30 October 2024.

Of the 69.69% of total unitholders that voted, 88.01% voted in favour and 11.99% voted against.

The detailed results of the vote at the meeting are as follows:

| Number of units | % of votes cast | % of eligible units | |

|---|---|---|---|

| In favour | 42,876,164 | 88.01% | 60.88% |

| Against | 5,842,279 | 11.99% | 8.29% |

| Abstain1 | 368,480 | 0.52% | |

| Total votes cast in the poll | 49,086,923 | 100.00% | 69.69% |

| Eligible units with no proxy | 21,345,434 | 30.31% | |

| Total units eligible to vote2 | 70,432,357 | 100.00% | |

| Resolution Result | Carried |

1. Votes cast by a person who abstains on an item are not counted in calculating the required majority on a poll.

2. In accordance with Section 253E of the Corporations Act, CFM and its associates have not voted on the Resolution

A successful ‘For’ vote extends the Term to 31 December 2026. Cromwell Funds Management will continue to monitor the market with a view to launching a further formal sale campaign during the Further Term, at the earliest time that it considers market conditions are favourable.

If you have any questions in relation to the vote, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS), the supplementary product disclosure statement dated 30 June 2009 (SPDS) and the Notice of Meeting and Explanatory Memorandum dated 30 October 2024 (NOMEM). The PDS, SPDS and NOMEM are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS, SPDS and NOMEM and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Dear Unitholder,

As responsible entity of the Cromwell Riverpark Trust (Trust), Cromwell Funds Management Limited (CFM) is calling a meeting of Unitholders to vote on the Term Extension Proposal for the Trust as detailed in the Notice of Meeting and Explanatory Memorandum (NOM) available here.

In accordance with Unitholders preferred method of communication (either by email or mail), each Unitholder will receive the NOM containing an individualised Proxy From with instructions on how to vote on the resolution.

The resolution is important for the Trust’s future and all Unitholders are being encouraged to vote, after carefully reading the Explanatory Memorandum.

Online votes and Proxy Forms must be received no later than 48 hours before the commencement of the Meeting, therefore by 10.30am (AEST) on Wednesday 4 December 2024.

Alternatively, a Unitholder or their proxy may vote in person at the meeting.

Meeting details

Date: Friday 6 December 2024

Time: 10.30am AEST (registration from 10.00am AEST)

Venue: Level 1, 100 Creek Street, Brisbane QLD 4000

The outcome of the Meeting will be posted by 5pm Monday, 9 December 2024 to the Continuous Disclosure and Updates section of the Trust’s website at https://www.cromwell.com.au/invest/fully-subscribed-and-closed-funds/cromwell-riverpark-trust/continuous-disclosure-updates/.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS), the supplementary product disclosure statement dated 30 June 2009 (SPDS) and the Notice of Meeting and Explanatory Memorandum dated 30 October 2024 (NOMEM). The PDS, SPDS and NOMEM are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS, SPDS and NOMEM and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Download the latest Cromwell Riverpark Trust Disclosure Guide here.

Dear Unitholder,

You may have recently received a letter from Leonard Anthonie van Veelen regarding the Cromwell Riverpark Trust (the Trust). Mr van Veelen is a unitholder in the Trust.

The letter sent to you by Mr van Veelen was not authorised or endorsed by Cromwell Funds Management Limited (CFM) (the responsible entity of the Trust). While CFM respects the rights of any unitholder to voice any concerns they may have in an appropriate manner, Mr van Veelen’s letter is in breach of various laws and contains allegations which have no basis and are denied by CFM.

Accordingly, we request that you disregard the letter. No action should be taken in relation to the letter.

Prepare for upcoming communications regarding the Trust

On 30 July 2024, we notified you of CFM’s proposal for unitholders to vote on extending the Trust’s investment term for up to two an additional year (Term Extension Proposal) . CFM proposes to issue a Notice of Meeting and Explanatory Memorandum in November calling a meeting of unitholders. The Notice of Meeting and Explanatory Memorandum will outline the Term Extension Proposal and provide details of the meeting and voting process. Unitholders will have the opportunity to ask questions and vote on the Term Extension Proposal at the unitholder meeting.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

Dear Unitholder,

This letter is an update on your investment in the Cromwell Riverpark Trust (the Trust).

In our correspondence to unitholders dated 27 June 2023, Cromwell Funds Management (CFM) outlined reasons for postponing a formal sale campaign for Energex House. At that time, CFM concluded that initiating a sale campaign would likely result in offers significantly lower than the property’s book value, owing to a limited pool of prospective buyers in the market. A copy of this communication can be found on this CDN page.

Since mid-2021, CFM has endeavoured to sell the property and has given due consideration to all offers. During this period CFM has continued to closely monitor the market, waiting for favourable financial conditions that it considered would yield offers closer to the current book value and result in a better outcome for unitholders. However, the market’s recovery has been slower than expected, and there has been continued economic volatility, resulting in opportunistic bids on properties from buyers nationwide.

Having regard to the present market conditions, CFM remains of the view that listing Energex House for sale would, once again, likely result in offers well below the property’s current book value of $270 million.

Next Steps

CFM acknowledges that unitholders had an expectation the property would be sold sooner than has occurred. However, due to the market conditions which have prevailed since then, CFM has been unable to secure offers which it considered in the best interest of unitholders. Having regard to the property’s fundamentals and given the current and projected market conditions, CFM is now intending to propose that unitholders extend the Trust’s investment term for up to an additional two years. If an extension is approved by unitholders, you will continue to get distributions from the Trust until a sale takes place.

CFM understands the lack of acceptable offers over the past two years is not the outcome which unitholders or CFM anticipated, and further extension of the term of the Trust might not align with the preferences of certain unitholders. Therefore, the term of the Trust will only be extended if unitholders pass an extraordinary resolution to extend the term. Further details regarding the meeting, the reasons CFM recommends unitholders vote in favour of the extension, and the continued payment of distributions will be provided via a Notice of Meeting and Explanatory Memorandum to be issued.

Market Update

According to a recent report provided to CFM by CBRE, there has been some cautious optimism in investment markets in 2024, with buyers being able to price assets with more confidence. However, inflation is not slowing as quickly as the Reserve Bank of Australia had forecast, which has led to some speculation in markets about the potential for further interest rate increases and has quelled some of this optimism.

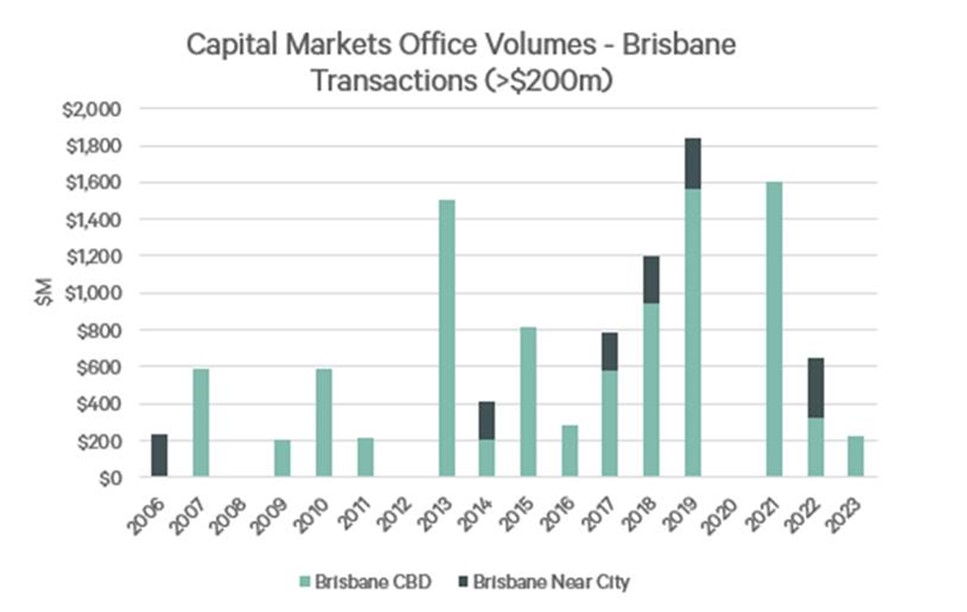

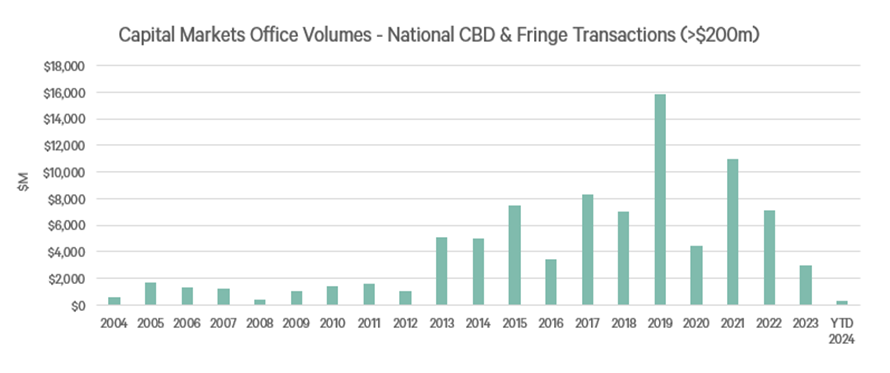

Brisbane commercial office sale volumes remain subdued, but several key transactions are underway indicating the potential for some form of recovery1. The buyers operating in the market with conviction are mainly high-net-worth investors or a small number of mid-tier funds with limited cash reserves.

Large institutional-grade transactions (over $200 million) have remained subdued due to constrained availability of capital and international buyers focusing on alternate sectors and markets such as Sydney for “prime” products. CBRE expects this to change over the next 12 months as limited quality opportunities present in Sydney and nervousness around the office sector dissipates. In Brisbane, Quintessential recently settled the acquisition of 240 Queen Street for $250 million, which took more than a year of negotiations with Brookfield (the vendor) to close and represented a 17% fall in value from the initial contracted price.

For a more in-depth property update visit Cromwell’s Direct Property Update here or access the PDF version here.

Property Update

Energex House is a high-end “A-grade”, near-city office asset comprising circa 30,000 sqm of office and retail space, with leading ESG design and performance. CFM continues to improve upon the efficiency of the property, recently installing approximately 200 solar panels which will generate 100kw of power and help maintain the current 6.0-star NABERS rating.

The property remains 100% occupied, with a weighted average lease expiry of 5.9 years as at 30 June 2024.

Since inception, the Trust has delivered an annualised total return of 10.5% per annum.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

A new external valuation has been obtained for Energex House, Newstead, Brisbane.

The property’s valuation has decreased to $270 million as a result of the capitalisation rate softening to 6.75%. This is an 8.0% decrease from the 30 November 2023 gross valuation of $293.4 million.

The asset remains 100% occupied, with a weighted average lease expiry of 5.9 years.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

Download the latest Cromwell Riverpark Trust Disclosure Guide here.

A new external valuation has been obtained for Energex House, Newstead, Brisbane.

The gross valuation of the property has decreased to $293.4m as a result of the capitalisation rate softening to 6.25%.

This revaluation has been reflected in the Fund’s NTA as at 30 November 2023. Closing unit price on 1 December 2023 was $1.820 with the Fund’s gearing at 41.8%.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

Download the latest Cromwell Riverpark Trust Disclosure Guide here.

Cromwell Funds Management Limited (CFM) has finalised an extension of the current debt facility for the Cromwell Riverpark Trust (Trust) with the Commonwealth Bank of Australia for a further two years with all other terms remaining the same.

CFM is pleased to confirm that the facility extension will also mark the transition to CFM’s first ever green loan, as certified by the Climate Bonds Initiative.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

Dear Unitholder

This letter is an update on your investment in the Cromwell Riverpark Trust (the Trust).

Background

In 2009, Cromwell Funds Management (CFM) successfully raised $91 million from you and other investors to purchase Energex House (the Property) for the Trust. By net lettable area, the Property is 92% leased to a Queensland government owned corporation, Energex Limited (now Energy Queensland) (Energex). The Energex lease is due to expire on 26 August 2030.

As an investment, the Trust has been one of Cromwell’s most successful, with monthly distributions increasing from 8.25 cents per unit per annum in the first year to 12.25 cents per unit per annum today. The value of the Property has also steadily increased from $173 million in August 2010 to $320 million at 30 April 2023 (gross valuation), which has been reflected in the Trust’s Net Tangible Assets (NTA) per unit. Distributions together with the movement in the NTA per unit has given the Trust an annualised performance since inception to 30 April 2023 of 13.2%. Please note however that past performance is not a reliable indicator of future performance, and the overall per annum return achieved by Unitholders on the winding up of the Trust following the sale of the Property may be lower or higher than this amount.

Sale process

The Trust reached the end of its investment term on 8 July 2021. In the lead up to this date and subsequently, CFM has considered how to achieve the best sale outcome for the Property. The final years of the term of the Trust coincided with the COVID 19 pandemic which created a period of uncertainty. During this period, Energex reviewed its space requirements and engaged in discussions to extend the lease.

CFM determined that finalising the negotiation of a lease renewal with Energex would be highly beneficial, locking in further income, and optimising the sale value of the Property. The lease negotiations were finalised in October 2021, resulting at that time in a total remaining lease term of 8 years and 10 months.

The sale process for the Property commenced in November 2021, with agents appointed in January 2022 and first round offers received in February 2022. However, the change in the Reserve Bank of Australia (RBA) cash rate and outlook for borrowing costs which occurred through 2022 to date, has contributed to a challenging period in which to complete a sale, at a price which CFM considers to be in the best interest of Unitholders. Currently, there is a lack of buyers in the market who are prepared to pay a price approaching the current independently assessed market value of the Property, meaning that the price achieved may only be a “market clearing value” and may not reflect the best outcome the Trust could achieve in the short to medium term. As a consequence, there has been no binding offer to acquire the Property.

In the opinion of CFM, there is a high risk that pursuing a sale campaign for the Property in the current environment may result in only opportunistic bids being received from potential buyers hoping to realise a bargain, leading to a sale price at a significant discount to the book value of the Property. This reflects the lack of buyer depth presently in the market for a high value, primarily single tenanted asset located outside the Brisbane CBD. CFM believes waiting for more favourable financial conditions may yield a sale price closer to the current book value and accordingly result in a better outcome for Unitholders.

After careful consideration, for the reasons outlined above, CFM does not believe re-launching a formal sale campaign in the current environment is in the best interests of Unitholders. While CFM will continue to endeavor to sell the Property as soon as practicable and will give due consideration to any offers to buy the Property, it acknowledges that it may take longer than expected to sell the Property in the current market. CFM will continue to monitor the market and intends to launch another formal sale campaign as soon as it considers the market conditions to be more favourable and it is more likely to achieve a sale price reflective of the market value in a stable environment.

CFM will keep Unitholders informed regarding a further sale campaign.

CFM believes the unprecedented speed of the increase in the official cash rate by the RBA has caused a ‘dislocation’ in the market. CFM appreciates that Unitholders invested in this Trust many years ago, individual circumstances may have changed over this period, and the delay in the sale of the Property may not be the preferred outcome for some Unitholders. Unfortunately, the Trust is unable to offer a liquidity opportunity or redeem units at this time.

What you need to do

There is no action required by you. CFM will continue to post updates on the Trust via the website www.cromwell.com.au/crt.

If you have any questions in relation to this letter, you can contact Cromwell Investor Services:

Phone:

1300 268 078

Email:

invest@cromwell.com.au

Letter:

Cromwell Riverpark Trust c/- Cromwell Property Group

Level 19, 200 Mary Street, Brisbane QLD 4000

Please quote your individual investor reference number (available on your distribution statement) in any correspondence.

Yours sincerely,

Tanya Cox

Chair, Cromwell Funds Management Limited

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this webpage and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This webpage has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given on this webpage. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Fund, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not indicative of future performance. Forward-looking statements in this update are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Fund are subject to the risks and assumptions set out in the PDS

Download the latest Cromwell Riverpark Trust Disclosure Guide here.

A new external valuation has been obtained as part of the ongoing sales process for Energex House, Newstead, Brisbane.

The gross valuation of the property has decreased to $320m as a result of the capitalisation rate softening to 5.75%.

This revaluation has been reflected in the Fund’s NTA as at 30 April 2023. Closing unit price on 1 May 2023 was $2.101 with the Fund’s gearing at 35%.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

Cromwell Funds Management (CFM) has successfully executed $120 million of new interest rate hedging for Cromwell Riverpark Trust (the Trust).

The Trust currently has a $130.25 million debt facility which is expected to be fully drawn by February 2024.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

Download the latest Cromwell Riverpark Trust Disclosure Guide here.

A new external valuation has been obtained as part of the ongoing sales process for Energex House, Newstead, Brisbane.

The gross valuation of the property has increased from the internal valuation as at 31 December 2022 of $325.4m to $328m. Despite the capitalisation rate softening from 5.5% to 5.625%, growth in market rents and some positive leasing outcomes have resulted in the net valuation of the asset lifting from $304m to $306.6m.

This valuation will be reflected in the December half year accounts for the Cromwell Riverpark Trust (Trust) by way of a net tangible asset value (NTA) for the Trust of $2.18.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS. in the PDS.

An internal valuation of Energex House, Newstead, Brisbane as at 31 December 2022 has been completed for Cromwell Riverpark Trust (Trust) unitholders. As a result of the capitalisation rate expanding from 5.375% to 5.5%, the gross valuation reduced from $334.9m to $325.4m. Despite this, the net valuation of the asset remains unchanged at $304m due to the expenditure of capital works to the End of Trip facility, the CPI rent review, and the reduction of the lease incentive provided to Energex as part of the previous lease extension.

The provisional net tangible asset value (NTA) of the Trust is forecast to decrease to $2.15 per unit as at 31 December 2022, down from $2.26 per unit as a result of the revaluation.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

An external valuation of Energex House, Newstead, Brisbane as at 30 June 2022 has been completed for Cromwell Riverpark Trust (Trust) unitholders, with the value of the asset decreasing from $316 million as at 30 September 2021 to $304 million as at 30 June 2022.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Cromwell Funds Management Limited has finalised the upsize and extension of a debt facility for the Cromwell Riverpark Trust (Trust). The current debt facility was upsized from $99.25 million to $130.25 million and the term of the debt facility was extended to June 2024.

If you have any questions in relation to the Trust, please contact Cromwell’s Investor Services Team on 1300 268 078.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333 214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

As per our previous update, the asset owned by the Cromwell Riverpark Trust, Energex House, located at 33 Breakfast Creek Road, Newstead, Queensland, entered into a due diligence period with a preferred buyer in March 2022. Recent movements in debt markets have unfortunately resulted in the preferred buyer being unable to commit to the asset purchase at this stage.

Cromwell Funds Management is committed to always act in the best interests of Unitholders and will continue to pursue the sale of the asset and the formal wind up of the Trust, however, as previously advised, this may take several months.

In the meantime, no action is required, and distributions will continue to be made at the current rate. Further updates will be distributed to Unitholders as and when required and information will also be made available on the Trust’s website at www.cromwell.com.au/crt.

If you have any questions in relation to the Trust, please contact Cromwell’s Investor Services Team on 1300 268 078.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this communication and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This communication has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this communication. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Cromwell Funds Management Limited as the responsible entity of the Cromwell Riverpark Trust (Trust) confirms that a preferred buyer has entered into a due diligence period with respect to the proposed sale of the Trust’s sole property located at 33 Breakfast Creek Road, Newstead, Queensland (Energex House).

As previously disclosed, the process of selling Energex House and winding up the Trust will take several months. We will communicate relevant updates as they occur. Information will also be made available on the Trust’s website at www.cromwell.com.au/crt. No action is required at present and distributions will continue to be made at the current rate.

If you have any questions in relation to the Trust, please contact Cromwell’s Investor Services Team on 1300 268 078.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333 214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

In November 2021, Cromwell Funds Management Limited (CFM), as trustee for the Cromwell Riverpark Trust (the Trust), announced it had executed a lease extension for Energex, the primary tenant within 33 Breakfast Creek Road, Newstead (Energex House). Pleasingly, the lease has been extended by a further five years; now expiring in August 2030 with two further option periods of five, and three years respectively. By having these leases in place, valuations have improved, as seen in the 30 September 2021 valuations.

CFM is committed to always act in the best interests of Unitholders, and as such, the process of marketing and selling the Trust’s property and winding up the Trust has now begun. In late-January CFM appointed Jones Lang LaSalle (JLL) and CBRE as agents to oversee the process of marketing and selling Energex House.

The process of selling Energex House and winding up the Trust will take several months, and we will communicate relevant updates as they occur. As it stands, no action is required on your end and distributions will continue to be made at the current rate.

If you have any questions in relation to the Trust, please contact Cromwell’s Investor Services Team on 1300 268 078.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (“CFM”) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (“Trust”). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (“PDS”) and the supplementary product disclosure statement dated 30 June 2009 (“SPDS”). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Past performance is not a reliable indicator of future performance. Forward-looking statements in this update are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS and SPDS.

Cromwell Funds Management Limited (CFM) as trustee for the Cromwell Riverpark Trust (the Trust) is pleased to announce the lease extension for Energex, the main tenant within 33 Breakfast Creek Road, Newstead (the Property), has now been formally approved by both CFM and Energy Queensland Limited (Energex owner). Binding lease documents have now been executed and the lease has been extended by a further five years, expiring in August 2030, with two further option periods of five years and three years respectively.

The current unit price of approximately $2.44 reflects the executed lease extension.

CFM is committed to always act in the best interests of Unitholders.

Unitholder feedback has indicated that after 12 years, the overwhelming preference is to wind up the Trust. As a result, CFM will now start the process of marketing and selling the Trust’s Property as soon as practicable.

The process of selling the Property and winding up the Trust will take several months. Appointment of selling agents is expected to occur in late 2021, with a campaign to market the Property for sale expected in late January 2022.

In the meantime, no action is required, and distributions will continue to be made at the current rate. Further updates will be distributed to Unitholders as and when required and information will also be made available on the Trust’s website at www.cromwell.com.au/crt.

If you have any questions in relation to the Trust, please contact Cromwell’s Investor Services Team on 1300 268 078.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (“CFM”) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (“Trust”). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (“PDS”) and the supplementary product disclosure statement dated 30 June 2009 (“SPDS”). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Past performance is not a reliable indicator of future performance. Forward-looking statements in this update are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS and SPDS.

An external valuation of Energex House, Newstead, Brisbane as at 30 September 2021 has provided good news for Cromwell Riverpark Trust (Trust) unitholders: a 12.5% increase in the value of the asset to $316 million, up from $281 million as at 30 June 2021.

The increase in value was underpinned by a five-year lease extension to the main tenant Energex taking the expiry from August 2025 to August 2030. Although the lease extension remains unsigned, the valuer considered the probability of the lease extension occurring as high, having regard to the advanced stage of legal documentation.

The provisional net tangible asset value (NTA) of the Trust is forecast to increase to $2.44 per unit at 30 September 2021, up from $2.08 per unit at 30 June 2021 as a result of the revaluation.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Past performance is not a reliable indicator of future performance. Forward-looking statements in this update are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS and SPDS.

Cromwell Funds Management Limited (CFM) is pleased to announce that distributions for the Cromwell Riverpark Trust (Trust) have been increased by 0.25 cents per unit (cpu) per annum from 1 July 2021 (payable August 2021).

The increase takes the distribution to 12.25 cents per unit per annum.

CFM’s decision to increase distributions by the Trust was underpinned by an increase in annual rental income.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this update and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This update has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this update. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS and SPDS for examples of key risks.

Past performance is not a reliable indicator of future performance. Forward-looking statements in this update are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS and SPDS.

On 8 July 2021, the Cromwell Riverpark Trust (Trust) reaches the end of its second term (Further Term). Understandably, Trust Unitholders and associated advisers are enquiring about next steps.

The Notice of Meeting and Explanatory Memorandum (documentation sent when the Trust’s term was extended) dated 20 May 2016, states that as soon as practicable after the end of the Further Term, Cromwell Funds Management (CFM) as responsible entity of the Trust will sell the Trust’s sole property at Energex House, 33 Breakfast Creek Road, Newstead (the property) and wind up the Trust, unless Unitholders vote by Extraordinary Resolution, to extend the term of the Trust again (see page 12, Section 5.2).

CFM has been in detailed discussions with Energex, the main tenant within the property about their future leasing requirements. The current lease expires in August 2025, with two further five-year options.

All options around the maturity of the Trust rely on the outcome of these discussions and we hope to have a clearer understanding of Energex’s intentions by July/August 2021. Depending on the outcome of the negotiations, either the asset will be marketed for sale, or Unitholders will again vote to continue or wind up the Trust.

If a vote is undertaken, there will be a lead-in voting timeframe of approximately six weeks and a matching facility will most likely be incorporated where Unitholders may have the opportunity to either sell their units and exit the Trust or buy additional units from those Unitholders wishing to sell.

There will be no CGT event from a sale of the property in the financial year ending 30 June 2021.

As soon as CFM has a clearer idea of the options, all Unitholders and advisers will be provided with more information. In the meantime, no action is required, and monthly distributions will continue to be paid. Further information will also be made available on the Trust’s website at www.cromwell.com.au/crt.

CFM will always act in the best interest of Unitholders.

If you have any questions in relation to the Trust or the Proposed Sale, please contact Cromwell’s Investor Services Team on 1300 268 078.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (“CFM”) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (“Trust”). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (“PDS”) and the supplementary product disclosure statement dated 30 June 2009 (“SPDS”). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note: Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

An external valuation of Energex House, Newstead, Brisbane as at 30 June 2020 has provided good news for Cromwell Riverpark Trust (Trust) unitholders: a 1.6% increase in the value of the asset to $281 million, up from $276.5 million as at 7 April 2020.

The increase in value was underpinned by an advancement in the COVID-19 rental relief negotiations. The increase takes the asset value to in excess of its pre-COVID-19 level of $280.5 million.

The provisional net tangible asset value (NTA) of the Trust is forecast to increase to $2.05 per unit at 30 June 2020, up from $2.00 per unit at 7 April 2020 as a result of the revaluation.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note:Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS.

Cromwell Funds Management Limited (CFM) is pleased to announce that distributions for the Cromwell Riverpark Trust (Trust) have been increased by 0.25 cents per unit (cpu) per annum from 1 July 2020.

The increase takes the distribution to 12.0% per annum, based on the unit issue price of $1.00. Distributions will continue to be paid monthly.

CFM’s decision to increase distributions by the Trust was underpinned by an increase in annual rental income.

If you have any questions, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM) has prepared this update and is the responsible entity of, and the issuer of units in, the Cromwell Riverpark Trust ARSN 135 002 336 (Trust). In making an investment decision in relation to the Trust, it is important that you read the product disclosure statement dated 25 February 2009 (PDS) and the supplementary product disclosure statement dated 30 June 2009 (SPDS). The PDS and SPDS are issued by CFM and are available from www.cromwell.com.au/crt or by calling Cromwell’s Investor Services Team on 1300 268 078. The Trust is not open for investment. This update has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and SPDS and assess, with or without your financial or tax adviser, whether the Trust fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this update. If you acquire units in the Trust, CFM and certain related parties may receive fees from the Trust and these fees are disclosed in the PDS and SPDS.

Please note:Any investment, including an investment in the Trust, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS and SPDS for examples of key risks.

Past performance is not a reliable indicator of future performance. Forward-looking statements in this update are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Trust are subject to the risks and assumptions set out in the PDS and SPDS.

Cromwell Funds Management COVID-19 Asset Valuations Update

COVID-19 continues to be an unprecedented global event and Cromwell recognises the urgent nature of the emergency, our responsibility to help ‘flatten the curve’ and contribute to the ensuing recovery in all the countries, cities and communities in which we operate.

Cromwell CEO, Paul Weightman, has stated, “We are conscious that we have a wide range of stakeholders including employees, securityholders, tenants, suppliers, contractors and service providers impacted by COVID-19.”

“We will act in a responsible way that balances the interests of all stakeholders and to ensure that the impact of the pandemic is not borne unfairly by any one particular group,” he added.

Cromwell Funds Management Unlisted Property Funds

Cromwell Funds Management (CFM) understands that many investors are concerned about the impact the COVID-19 crisis might have on their investment balance in one of CFM’s unlisted property funds.

Unlike listed markets which provide transparent, albeit often volatile pricing, assessing the valuation of unlisted assets is more difficult at a time when there is little transactional activity to allow for the benchmarking, and then valuing, of an asset. It is clear, however, that property and other asset types have been adversely affected by the crisis.

CFM has a fiduciary duty to ensure that all investors in the funds, those applying for new units and those redeeming their units are treated equitably.

CFM has therefore quantified the valuation impact on a tenant by tenant basis based off current information. As a result, the valuations of directly held property assets within the Cromwell Direct Property Fund, Cromwell Riverpark Trust, Cromwell Ipswich City Heart Trust and Cromwell Property Trust 12 have been devalued by 5.9%, 1.4%, 2.4% and 1.6% respectively.

The revaluations have now been included in each Fund’s unit pricing and are consistent with many superannuation funds and unlisted property fund managers who have reduced valuations of unlisted property and infrastructure assets in a range of 7% to 10%.

Based on information currently available there is no change to forecast distributions across the Funds and the Cromwell Direct Property Fund remains open for investment.

CFM will continue to monitor the property investment market closely to ensure the pricing of our unlisted assets remains appropriate and that all investors are treated equitably.

If you have any questions or would like to speak to someone about your investment, please contact Cromwell’s Investor Services Team on 1300 268 078 or email invest@cromwell.com.au.

An external valuation of Energex House, Newstead, Brisbane as at 30 June 2019 has provided good news for Cromwell Riverpark Trust (Trust) unitholders: a 2.4% increase in the value of the asset to $280.5 million, up from $274 million as at 31 December 2018.

The increase in value was underpinned by an increase in market rents.