Cromwell Phoenix Opportunities Fund

This fully subscribed fund is now closed to investment. Distribution reinvestment and redemptions from the Fund are still available.

Cromwell Phoenix Opportunities Fund

This fully subscribed fund is now closed to investment. Distribution reinvestment and redemptions from the Fund are still available.

This value orientated fund invests in ASX-listed microcaps using Phoenix Portfolios’ ‘best ideas’ approach and aims to find hidden value in under-researched stocks.

Microcaps typically have little analyst coverage as institutions are unable to deploy meaningful amounts of capital and therefore cannot justify investing in research. This means many companies outside the main ASX indices are under-researched and undiscovered. This can give rise to situations where companies trade well below assessed value. Phoenix seeks to identify pricing discrepancies in these ‘under-researched’ stocks and blend together a portfolio of investments that offers the highest risk adjusted after-tax expected return.

Information for existing investors

Cromwell follows ASIC’s good practice guidance for website disclosure of material information. This means that all material information in relation to the Cromwell Phoenix Opportunities Fund will be posted on this webpage as soon as practicable after Cromwell becomes aware of it.

View tax information for the fund.

Register your interest to receive the fund investment report

Thank you for your interest in the Cromwell Phoenix Opportunities Fund. To access the latest investment report for the Fund, please fill out the form below.

Fund snapshot

Fund Objective

The objective of the Fund, over rolling 5 year periods is to:

- Deliver a total return in excess of inflation2 (as measured by the Consumer Price Index) plus 7.5%; and

- Outperform the S&P/ASX Small Ordinaries Accumulation Index (“Benchmark”) after fees and costs.

Investment Strategy

Microcaps typically have little analyst coverage as institutions are unable to deploy meaningful amounts of capital and therefore cannot justify investing in research. This means many companies outside the main ASX indices are under-researched and undiscovered. This can give rise to situations where companies trade well below our assessed value.

We seek to identify pricing discrepancies in these ‘under-researched’ stocks and blend together a portfolio of investments that offers the highest risk adjusted after-tax expected return. The Fund will typically hold between 15 and 40 investments. There is a cap on the Fund size to maximise performance potential.

Investments

Investments are likely to be in small companies with the majority selected from outside the top 300 listed securities.

Benchmark

Investments are likely to be in small companies with the majority selected from outside the top 300 listed securities.

Fund Inception

S&P/ASX Small Ords.

Date commenced

23 December 2011.

Risk and Volatility

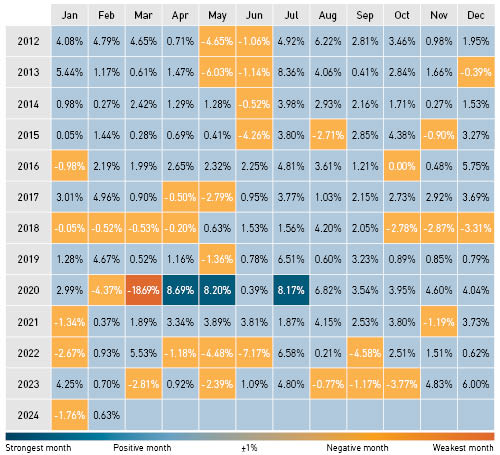

The heat map shows the historic volatility of the Fund. CFM believes that it is important for investors to be aware of this to ensure their risk appetite isn’t compromised through their choice of investment. Past volatility is not an indication of future volatility.

Disclaimer: Capital growth and income distributions are not guaranteed and are subject to the assumptions and risks contained in the PDS. Past performance is not a reliable indicator of future performance.

Risk Disclosure

Any investment, including an investment in this Fund, is subject to risk. If a particular risk eventuates it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. Examples of key risks include: manager risk, market risk and liquidity risk. See Section 4 of the Fund’s product disclosure statement dated 29 September 2017 (“PDS”).

Past performance is not indicative of future performance. Forward-looking statements in this webpage are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Fund are subject to the risks and assumptions set out in the Fund’s PDS.

Open for investment: Cromwell Phoenix Global Opportunities Fund

This Fund builds on the strategy used by the Cromwell Phoenix Opportunities Fund and invests in predominantly small cap securities listed in offshore developed markets, trading at discounts to their readily assessable intrinsic values. The Fund was seeded in 2019 and is now available to external investors. If you would like further information about the Cromwell Global Opportunities Fund, please fill out the form below.

How to apply

The fully subscribed Fund is now closed to investment. Distribution reinvestment and redemptions from the Fund are still available. If you have any questions regarding the Fund, please contact your financial adviser or Cromwell Investor Services below.

Contact us

Jonathan has 20 years’ experience in equity markets and investing. He is responsible for maintaining relationships with Cromwell’s direct retail investors.

Book a meeting with JonathanFootnotes

- Total return as at 30 September 2024 (inception at December 2011), after fees and costs, inclusive of the value of franking credits. Past performance is not a reliable indicator of future performance.

- Inflation as measured by the Consumer Price Index

Disclaimer

Units are issued by the Fund at a unit price determined in accordance with the Responsible Entity’s Unit Pricing Policy. Per the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority’s (APRA’s) Unit Pricing: Guide to Good Practice, investors will receive compensation for any material unit pricing errors. In accordance with these guidelines the Fund does not pay exited members compensation for material unit pricing errors where the amount of any compensation payable is less than $20.

Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (“CFM”) has prepared this notice and is the responsible entity of, and the issuer of units in, the Cromwell Phoenix Opportunities Fund ARSN 602 776 536 (“Fund”). In making an investment decision in relation to the Fund, it is important that you read the product disclosure statement dated 29 September 2017 (“PDS”). The PDS is issued by CFM and is available from www.cromwell.com.au/pof or by calling Cromwell’s Investor Services team on 1300 268 078. The Fund is closed to new investment. This notice has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision, you should consider the PDS and assess, with or without your financial or tax adviser, whether the Fund fits your objectives, financial situation or needs. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in this notice. If you acquire units in the Fund, CFM and certain related parties may receive fees from the Fund and these fees are disclosed in the PDS. Phoenix Portfolios Pty Ltd ABN 80 117 850 254 AFSL 300302 (“Phoenix”) is the investment manager of the Fund. None of CFM, Phoenix, nor their related entities, directors or officers makes any promise or representation, or gives any guarantee as to the success of the Fund, distributions, the amount you will receive on withdrawal, your income or capital return or the tax consequences of investing.

Please note: Any investment, including an investment in the Fund, is subject to risk. If a risk eventuates, it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the PDS for examples of key risks. Past performance is not a reliable indicator of future performance. Forward-looking statements in this notice are provided as a general guide only. Capital growth, distributions and tax consequences cannot be guaranteed. Forward-looking statements and the performance of the Fund are subject to the risks and assumptions set out in the PDS.