December 2025 quarter ASX A-REIT market update

Stuart Cartledge, Managing Director, Phoenix Portfolios

Market Commentary

The S&P/ASX 300 A-REIT Accumulation Index lost 1.2% over the December quarter, marginally underperforming the broader equity market, with the S&P ASX 300 Index off 0.9%.

With property transaction markets open once more, property fund managers were strong performers in the period. Centuria Capital Group (CNI) was busy expanding its agricultural real estate business. Firstly, its unlisted Centuria Agricultural Fund (CAF) secured the purchase of Australia’s largest hydroponic greenhouse for $168 million. It then acquired agricultural property business Arrow Funds Management adding a further $444 million of agricultural funds to its platform. It finished the quarter up 31.2%. HMC Capital Limited (HMC) showed some signs of stabilisation amongst what has been a challenging year, gaining 24.5% over the quarter, but remaining down 58.6% for the full year. Charter Hall Group (CHC) also showed good momentum, upgrading operating earnings per security (OEPS) guidance by 5.5%, supported by heightened investment activity within its property investment and funds management platform. CHC finished the period 8.6% higher. Somewhat bucking the trend was Goodman Group (GMG) which disappointed some market participants by not upgrading its own earnings guidance and providing no details on new funds management products at its quarterly update. This was somewhat rectified in December, with the announcement of a $14 billion data centre partnership with CPP Investments. GMG closed the quarter down 5.0%.

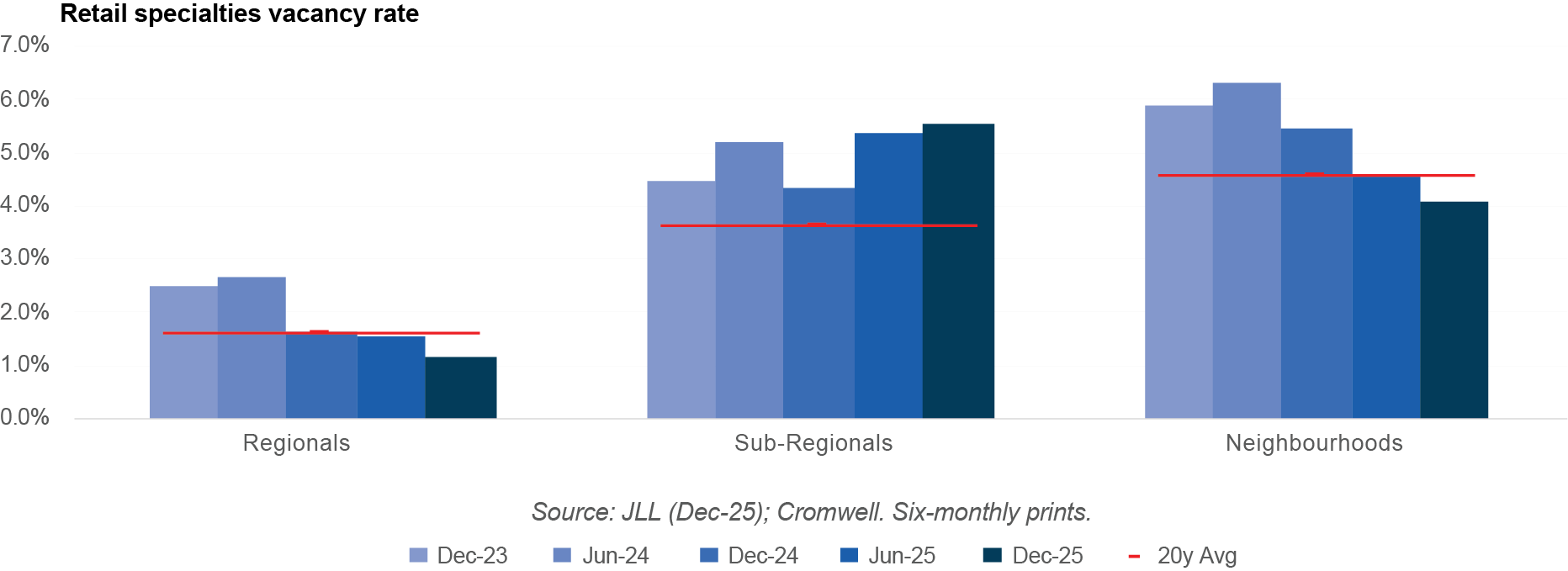

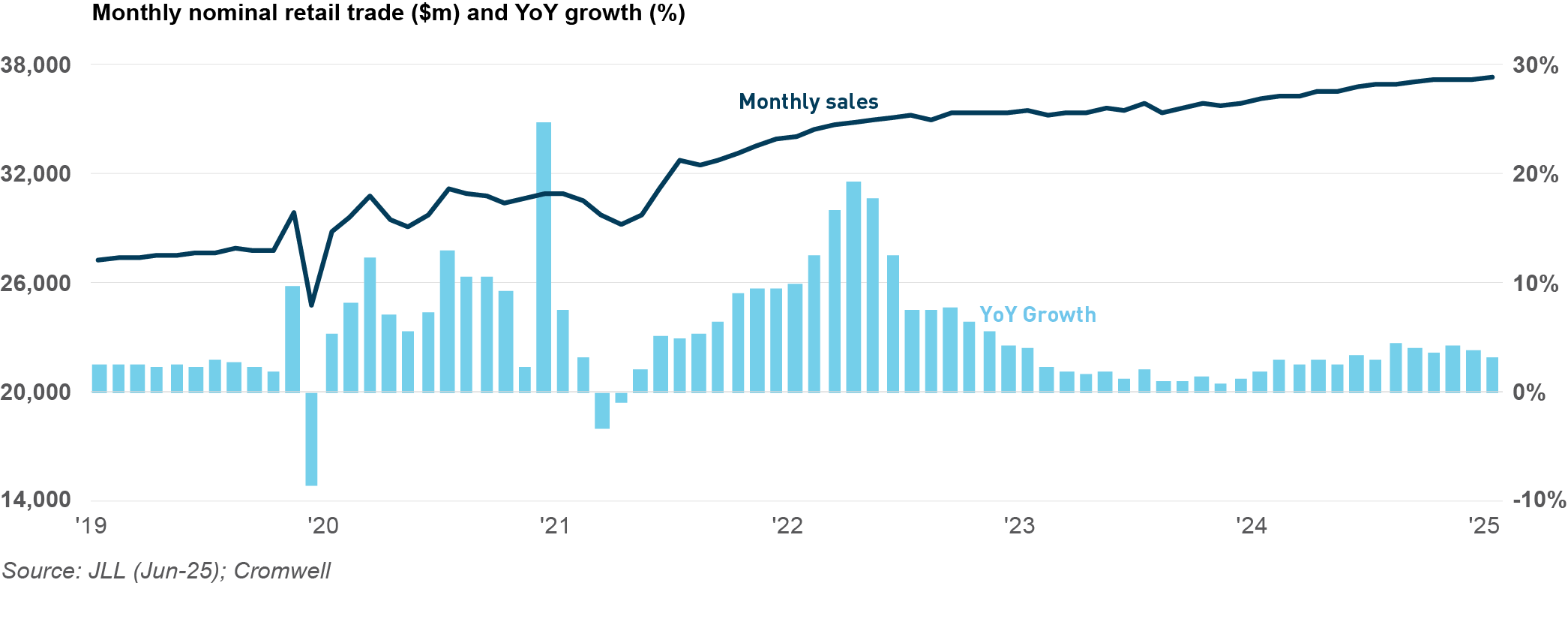

Retail property owners performed well in the period. Ongoing solid rent growth, supporting by an increasing population and limited new supply is restoring the negotiating power of shopping centre owners. Regional mall owner Scentre Group (SCG) gained ground, adding 2.9%, whilst competitor Vicinity Centres (VCX) rose 1.6%. SCG-managed Carindale Property Trust (CDP) gained 5.6%, as the Lendlease Group (LLC) fund that owns a stake in the Westfield Carindale Shopping Centre appears to be on a trajectory to wind up. Owners of smaller neighbourhood shopping centres also outperformed, with Region Group (RGN) up 1.2% and Charter Hall Retail REIT (CQR) eking out a 0.1% gain.

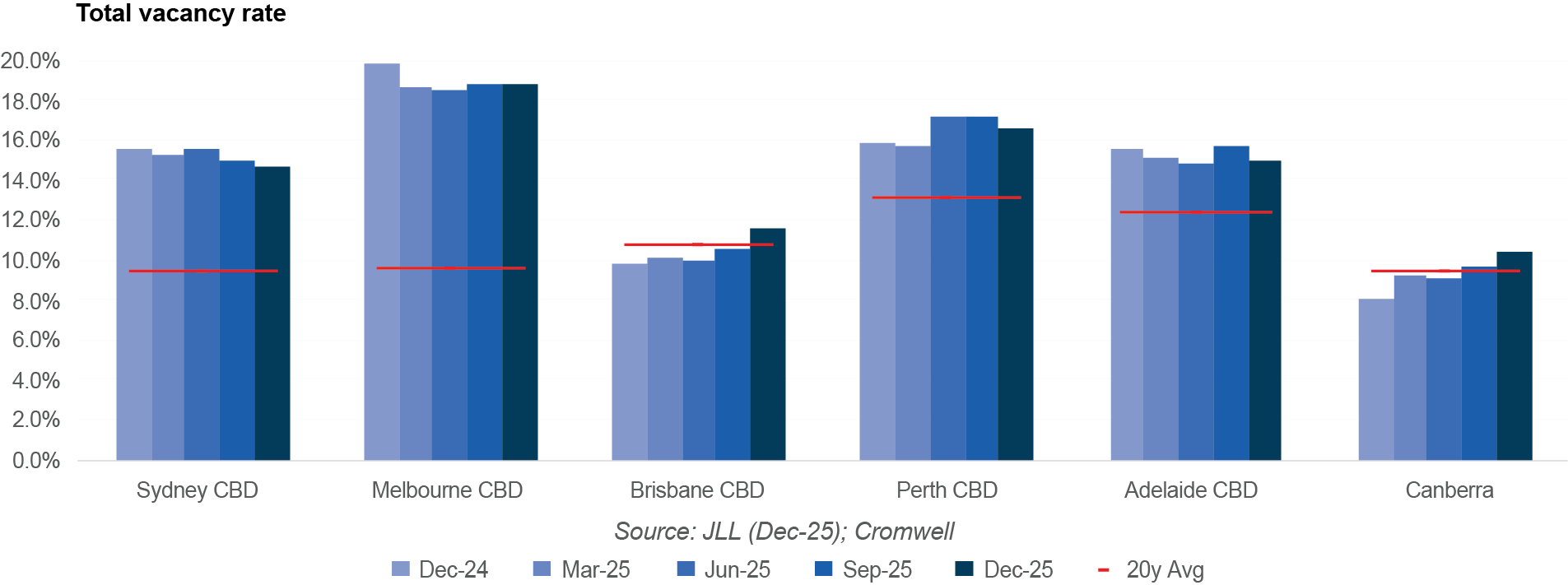

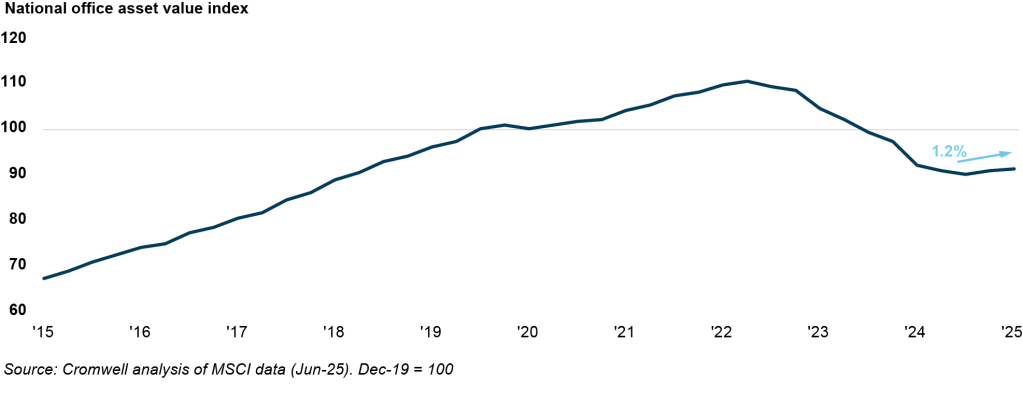

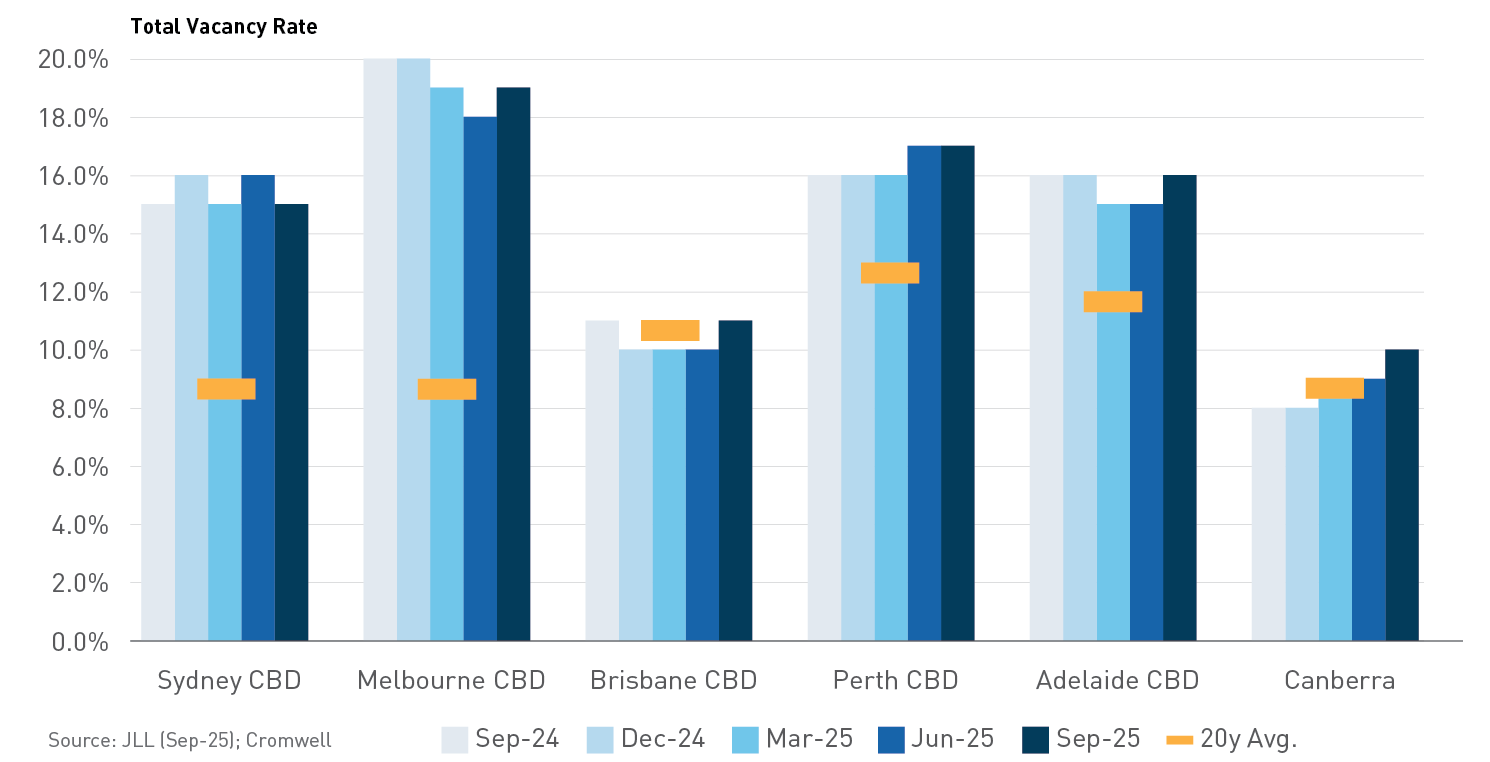

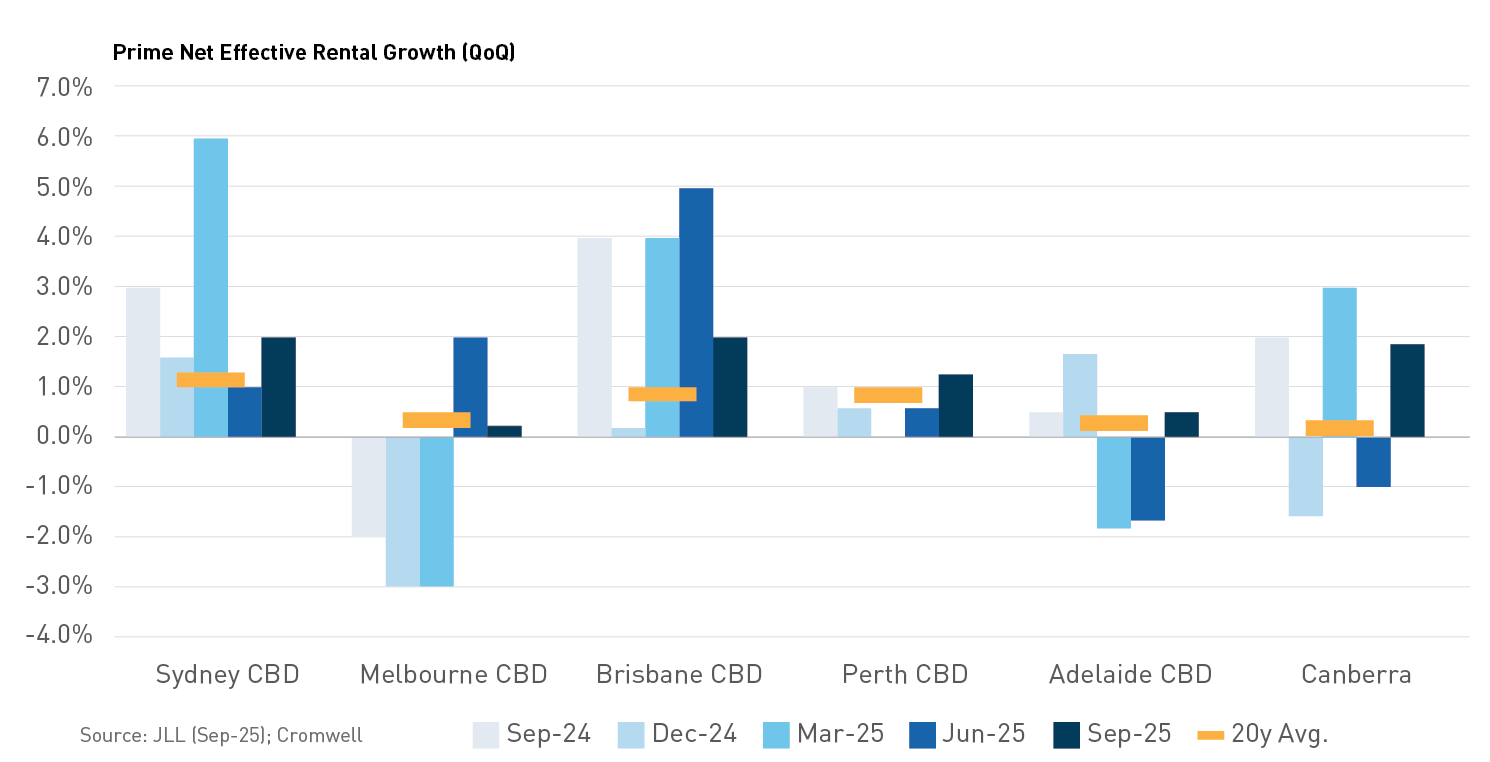

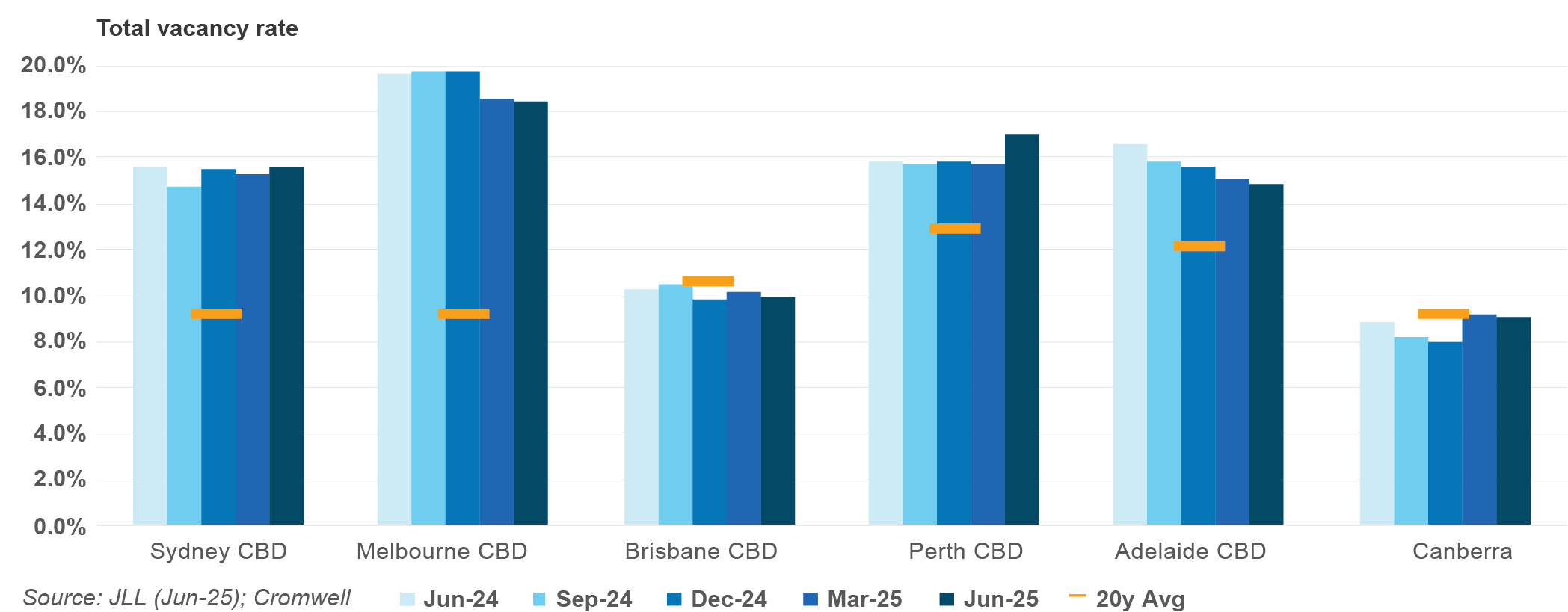

Office property owners displayed some weakness in the quarter as bifurcation in the rent growth and values of office properties across jurisdictions and class appears to be widening. The cores of the Sydney and Brisbane CBDs appear to be recovering, with investor interest in those areas reemerging. Suburban and secondary locations are finding it more difficult to attract robust bidding and are seeing persistent elevated incentives. Smaller office property owners Centuria Office REIT (COF) and GDI Property Group (GDI) underperformed the market, losing 2.1% and 2.9% respectively. Mirvac Group (MGR) was a laggard, dropping 7.6%, while large cap competitor, Dexus (DXS) only gave up 0.8%.

Long weighted average lease expiry (WALE) property owners were amongst the weakest in the period. This property is particularly sensitive to longer term interest rates. With the Australian 10 Year Government Bond yield increasing from approximately 4.3% to 4.8% over the quarter, it is unsurprising that this property underperformed. Childcare property owners were weakest, facing higher interest rates and negative sentiment towards the sector. Charter Hall Social Infrastructure REIT (CQE) gave up 7.9%, while Arena REIT (ARF) lost 7.0%. It is worth noting that direct market transactions for this type of property appear to remain robust. Owners of petrol station properties fared somewhat better, but still underperformed, with Waypoint REIT (WPR) and Dexus Convenience Retail REIT (DXC) off 4.0% and 4.3% respectively.

Australia’s residential housing market is at an interesting juncture, with chronic undersupply running into ever increasing affordability concerns. Across the period, it appears as if house price momentum has stalled in Sydney and Melbourne, however, continues to march on in Brisbane, Perth and Adelaide. After producing solid returns earlier in the year, residential property developers lost some ground in the period. Peet Limited (PPC) announced the conclusion of its strategic review, with more of an “evolution” than a “revolution” in strategy. It was down 1.0% over the period. Perth-focused Finbar Group Limited (FRI) gave up 4.0%, however has restocked its project pipeline for the coming years. Large cap developer, Stockland (SGP) dropped 4.9%, easing after strong performance earlier in the year.

How did the Cromwell Funds Management fare this quarter?

How did the Cromwell Funds Management fare this quarter?

Brendan Sim, Cromwell Development Manager: We are proud of our track record of delivering projects on time, to scope and to budget. Despite having four separate contractors working simultaneously within the building, we delivered the project under budget and handed it over early.

Brendan Sim, Cromwell Development Manager: We are proud of our track record of delivering projects on time, to scope and to budget. Despite having four separate contractors working simultaneously within the building, we delivered the project under budget and handed it over early.

Maria Correia, Gray Puksand: Cultural shifts in workspace design have evolved significantly over the past few decades, driven by changes in work practices, technology, employee preferences, and broader societal trends. There are several trends emerging some of which we have integrated into the Cromwell workspace however with the rise of the AI workplace, I think moving forward it would be good to focus on the ‘human centric’ workplace trends outlined below.

Maria Correia, Gray Puksand: Cultural shifts in workspace design have evolved significantly over the past few decades, driven by changes in work practices, technology, employee preferences, and broader societal trends. There are several trends emerging some of which we have integrated into the Cromwell workspace however with the rise of the AI workplace, I think moving forward it would be good to focus on the ‘human centric’ workplace trends outlined below.