Tracking the office recovery – five charts that tell the story

Colin Mackay, Research & Investment Strategy Manager, Cromwell Property Group

After a 19-year premiership drought, the Broncos have returned to the top of the rugby league totem pole. Another redemption story, not as long in the making, is underway in commercial real estate. Office was out of favour through the pandemic, weighed down by rising interest rates, subdued liquidity, and concerns that remote work would irreparably damage demand for space. Now, conditions are improving and sentiment is becoming more positive – and the proof is in the total return pudding. Below are five charts that highlight the recovery occurring in the office sector.

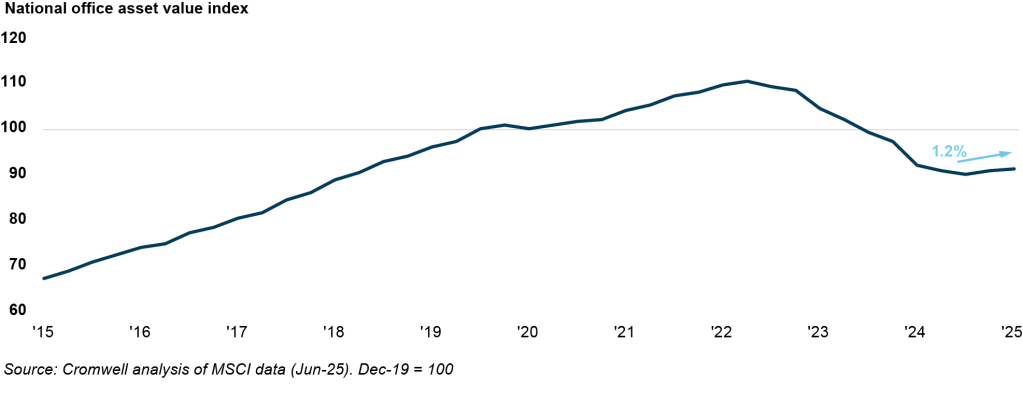

1. Asset prices appear to have bottomed

Office asset values across Australia fell -18% from late 2022 to the end of 2024. The devaluation cycle appears to have concluded, with appreciation of +1.2% recorded over the first half of 20251 . The downturn has created a compelling entry point for investors – office is currently providing a larger yield premium over the Australian 10-year Government Bond compared to the 30-year average.