Navigating the challenges

There are a number of ways investors can safeguard against the above risks and maintain their desired quality of life in retirement.

Make a plan

A November 2020 Australian Government report into retirement planning, saving, and attitudes found that many respondents were unprepared for life beyond work, with 68% of respondents admitting they had never considered how much they would need for retirement.

The majority (80%) of the remaining 32% of respondents who had estimated a retirement savings goal understood how much they needed to save per year to reach this goal, with 60% changing their behaviour after calculating how much they needed for retirement.

These statistics show the importance of making a plan. Understanding what is required to achieve your desired lifestyle in retirement will greatly assist in helping you putting together an accurate plan. There are countless resources available to assist you, including the Moneysmart retirement planner and Cromwell’s ‘Countdown to Retirement’.

Don’t underestimate the impact of inflation

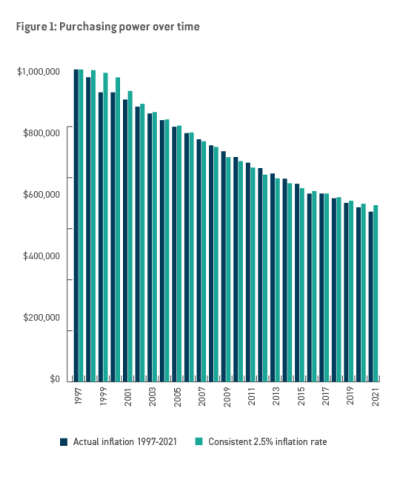

It’s important to understand the impact of inflation on your purchasing power, and the way in which it can chip away at savings, as well as understanding its impact on your investment portfolio.

Inflation above anticipated levels is generally considered detrimental to stocks and fixed income investments; however, real assets, including real estate, land, precious metals, commodities, and natural resources tend to fare well in times of high inflation.

Income from real assets is generally linked to inflation. For example, it is common for commercial real estate leases to have annual rent increases tied directly to increases in inflation – this is why commercial property is regarded as an inflationary hedge.

Understand your investment income

Understanding your investment income is straightforward, but it is the most important factor throughout retirement. Not only should you understand your income sources, but it is important to set realistic expectations that will allow you to live comfortably.

Retirement casts a new light on investment opportunities, particularly relating to an investor’s risk profile and unfamiliar tax scenarios: it is important for investors to look beyond familiar investment options to diversify and spread their risk across multiple sectors, geographic regions, and asset classes. Without a regular source of income, retirees need to minimise their longevity risk by looking for investments that offer both returns and capital growth.

Don’t underestimate how long you will live

Consider this: The retirement age in Australia is generally understood to be 67 years old, which is when an individual qualifies to receive Government Age Pension benefits – the main source of income for most retirees.

However, according to the ABS, the average retirement age of all retirees as of May 2020 (the most recent information available) was 55.4 years, with 55% of people over 55 retired. By the time most individuals reach 65 years of age, they are now expected to live for another two decades. This means a person retiring at age 55 must stretch their finances for, on average, another 30 years.

It’s important to note this is merely an average, many will live far longer than two decades from their 65th birthday. Therefore, it is vital to overestimate your own life expectancy, rather than underestimate it.

Consider unforeseen expenses

With luck, unforeseen expenses can be kept to a minimum; however, it is important to factor these in, nonetheless. Whether these costs are associated with real estate maintenance or repairs, having to care for a loved one in a crisis, or looking after your own personal wellbeing, unforeseen costs can be significant and need to be a key consideration.

Former United States Secretary of Defense, Donald Rumsfeld, offered the following in a February 2002 news briefing:

“There are known knowns: There are the things we know. We also know there are known unknowns: That is to say we know there are some things we do not know. But there are also unknown unknowns: The ones we don’t know we don’t know.

… It is the latter category that tends to be the difficult ones.”

There are known knowns: There are the things we know. We also know there are known unknowns: That is to say we know there are some things we do not know.

Donald Rumsfeld – Former United States Secretary of Defense

This quote is apt with regard to navigating retirement risks. It is not possible to predict how long an individual will live or the exact level of savings required to maintain a desired quality of life in retirement. However, understanding as best as possible the ‘known unknowns’ and being prepared to weather the ‘unknown unknowns’ is the best method to ensuring a long and comfortable retirement.