Maximise the benefits of listed property exposure without concentration and geopolitical risks

Stuart Cartledge, Manager Director, Phoenix Portfolios

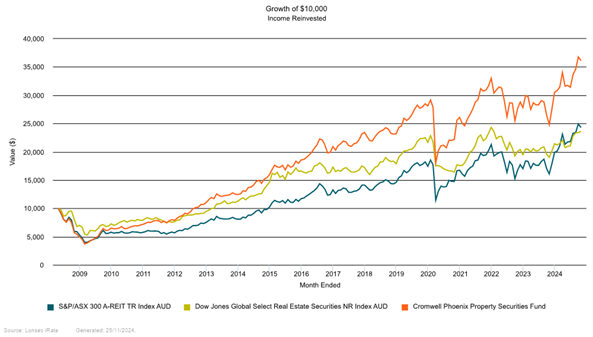

Listed property has long been a trusted avenue for investors seeking sustainable income and exposure to commercial real estate. However, recent trends have seen some asset consultants shift towards global property securities, raising questions about concentration risk in the local market. A broader, benchmark-unaware approach can help investors navigate these risks while maximising long-term returns.

The case for listed property

Navigating sector and stock concentration within the Australian listed property market can be challenging. However, there are compelling reasons to maintain exposure to listed property as part of a diversified portfolio: