An end-to-end success, delivering a 14.2% annualised return since inception¹

After fees and costs, as at 31 December 2021.

An end-to-end success, delivering a 14.2% annualised return since inception¹

After fees and costs, as at 31 December 2021.

Case Study: Cromwell Ipswich City Heart Trust

The December 2011 inception of the Cromwell Ipswich City Heart Trust (ICH or the Trust) marked the second investment trust Cromwell Funds Management (Cromwell or CFM) launched. From the Trust’s initial capital raise completing early and oversubscribed, to an overwhelming ‘yes’ vote for a further Term, and an unsolicited offer to sell the Trust’s asset at a significant premium to valuation, ICH was a success from end-to-end.

Cromwell identified an opportunity

Across 2011, world markets were experiencing volatility and towards the end of the year, interest rates had begun to trend downwards, subsequently reducing the yields offered by cash and term deposits. As a result, investor demand heightened for simpler, single-asset investment vehicles.

As such, Cromwell sought to launch its second ‘back to basics’ investment vehicle which offered distributions that were a premium to those offered by term deposits.

Trust inception

In December 2011, Cromwell issued a product disclosure statement which sought to raise $49.25 million to be used in conjunction with debt to fund the construction of the Ipswich City Heart Building, a state-of-the-art, environmentally friendly building in the centre of Ipswich, Queensland.

The application period to raise the $49.25 million was set for one year, with a deadline of 31 December 2012. However, in early-October 2012, Cromwell announced applications had closed earlier than planned and oversubscribed. This highlighted the trust investors had in Cromwell, the success of the Cromwell Riverpark Trust before it and the continuing appeal of simple, transparent, yield-based products underpinned by quality Australian commercial property assets.

More than 800 unitholders invested in the Trust, many of whom were first time investors in a Cromwell-managed trust. In addition, while the minimum investment was $10,000, the average investment size was approximately $50,000.

The Trust was initially launched as a seven-year, single property syndicate with commencing distributions at a rate of 7.75% p.a. paid monthly and forecast to increase to 8.00% p.a. from July 2013 and 8.25% p.a. from July 2014.

Responsible Investment Association of Australasia certification

In September 2012, the Trust became the first single-asset property investment vehicle to be certified by the Responsible Investment Association of Australasia (RIAA) as a Responsible Investment.

The RIAA champions responsible investing and a sustainable financial system across Australia and New Zealand, and is dedicated to ensuring capital is aligned with achieving a healthy society, environment and economy.

Cromwell was an early adopter of incorporating environmental, social and governance (ESG) factors into its investment analysis and decision-making process, while demonstrating that sustainability can be a pathway to profitability at an asset level. The Trust’s Responsible Investment certification ensured investors who took RIAA certified products into consideration now had the option to include exposure to direct commercial property, thereby providing further diversity to their portfolios.

The Initial Term

Across the Initial Term of the Trust, distributions increased incrementally from 7.75 cents per unit (cpu) p.a. to 9.5 cpu, aligning with the annual rental increases paid by the Queensland Government tenant and the subsequent building valuation increases.

At the time of practical completion, the Ipswich City Heart Building was valued at $93 million. In June 2018, the valuation prior to the conclusion of the Trust’s Initial Term had increased significantly to $123 million.

Unitholders vote to continue the Trust

As the end of its initial seven-year term in December 2018 was approaching, unitholders were asked to have their say about the future of the Trust. As the largest unitholder represented less than 3.0% of total units on issue, every vote counted in reaching a bona fide outcome.

Cromwell’s Investor Services Team worked tirelessly over the five-week voting period in the lead up to the 26 September 2018 Meeting to ensure unitholders were aware of the vote and the potential outcomes of the Rollover Proposal.

The two key terms of the Rollover Proposal were to:

- Extend the term of the Trust for four-and-a-half years to 28 June 2023; and

- Provide unitholders with a Matching Facility which would give them the ability to either:

a. acquire more units at the Matching Price of $1.4041; or

b. sell some or all of their units at the Matching Price.

With over 800 unitholders and 52.5 million units in the Trust, the vote saw a participation rate of 83.82%. Of this, 98.42% voted in favour of the Further Term Resolution (Resolution 1), with 99.22% voting in favour of Resolution 2.

As a result, the successful ‘For’ vote on Resolution 1 extended the Trust Term by four-and-a-half years, while the successful ‘For’ vote on Resolution 2 set the Matching Facility in motion.

Overwhelming demand for more units

At the time of the vote, interest rates were at historic lows and support to retain the Trust was unsurprising. The Meeting outcomes reinforced unitholder confidence in the Trust, lauding it for its predictable monthly income, single-asset investment, conservative leasing fundamentals and excellent capital growth.

The interest from unitholders in the Matching Facility was overwhelmingly popular, with applications to purchase additional units in the Trust far exceeding those units offered for sale, resulting in all buyers having their purchase scaled back to 20.51% of units applied for.

The Matching Facility was finalised on 1 November 2018, with the transfer of units complete and sellers receiving their proceeds for units sold. Unitholders who sold their units at the Matching Price of $1.4041 achieved an annualised return of 14.0% since inception.

The Further Term

The Further Term commenced on 29 December 2018, with the announcement that distributions were set to increase to 11.0 cpu p.a. from January 2019 following shortly thereafter.

Unsolicited offer to sell the Ipswich City Heart Building

In March 2021, Cromwell Funds Management, as responsible entity of the Trust, received a sale offer for the Ipswich City Heart Building for $145.2 million. The premium of the offer to the book value at the time of $128.5 million was substantial.

In the Notice of Meeting and Explanatory Memorandum, the document circulated when the Trust’s term was extended, it stated that after two years (being 28 December 2020), CFM could sell the property without a unitholder vote and wind up the Trust if it secures a higher price than the most recent valuation, while deeming it in the best interest of unitholders to do so.

With less than two years to maturity, CFM deemed money-in-the-hand was the right outcome for unitholders. As such, on 28 May 2021, CFM entered into an agreement to sell the asset.

The sale settled on 21 October 2021 for $144.9 million, representing the largest ever sale of an office building in Queensland outside of Brisbane at the time.

Special distribution

Off the back of the sale, a special distribution of $1.75 per unit, representing the majority of the sale proceeds, was paid in November 2021.

Termination notice and Trust wind up

The Trust was terminated on 18 November 2021, with a final distribution of $0.0104344130 per unit paid on 10 February 2022. On 19 April 2022, CFM announced the Trust had been formally wound up.

An end-to-end success

The Cromwell Ipswich City Heart Trust was an end-to-end success, delivering a 14.2% annualised return since inception (after fees and costs) as at 31 December 2021. The Trust utilised the real expertise of Cromwell Funds Management to identify and invest in a real asset that delivered real returns¹.

The Cromwell Riverpark Trust was Cromwell’s first investment trust. Access is available exclusively via the Cromwell Direct Property Fund.

The Ipswich City Heart Building

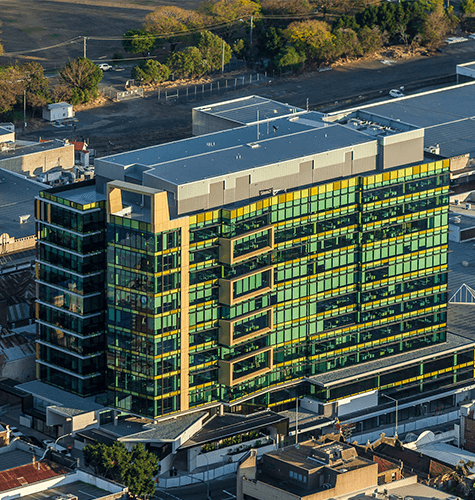

Located southwest of Brisbane at 117 Brisbane Street in Ipswich, The Ipswich City Heart Building formed part of Stage 1 of the $1 billion redevelopment known as ICON Ipswich.

At the time, ICON Ipswich was one of Australia’s largest urban renewal projects, which spanned four city blocks and delivered approximately 170,000 sqm of master-planned commercial, retail, residential and public space. The project was designed to revitalise the city of Ipswich, which in 2011 was one of the top five national growth centres in Australia, with a population of around 175,000 that was projected to increase to 462,000 by 2031.

The nine-storey, Property Council of Australia A-grade building pre-let 91% (17,866 sqm) of the net lettable area to the Queensland State Government’s Department of Public Works on a 15.5-year lease (from the date of the PDS). Additionally, the lower levels comprise 2,134 sqm of retail space, as well as a basement car park accommodating 206 vehicles, 11 motorbikes and 120 bicycles.

In November 2013, the building reached practical completion, where it became the first building in Ipswich to be awarded a 5-Star Green Star Design and As Built rating. Under the rating tool, a 5-Star rating signifies ‘Australian Excellence’ in environmentally sustainable design and construction, responding to the Queensland Government’s requirement for a purpose-built, long-term flexible working environment.

In addition, the building was awarded a 4.5-Star NABERS Energy and 4-Star NABERS Water rating.

Footnotes

- Capital growth and income distribution are not guaranteed and are subject to the assumptions and risks contained in the PDS. Past performance is not a reliable indication of future performance.

Important information

This notice has been prepared by Cromwell Funds Management Limited ABN 63 114 782 777 AFSL 333214 (CFM). This notice is not intended to provide investment nor financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions. Neither CFM nor Phoenix Portfolios Pty Ltd ABN 80 117 850 254 AFSL 300 302 (Phoenix) receive any fees for the general advice given in this notice.

CFM has prepared the fund summarises and is the responsible entity of, and the issuer of units in, the funds referred to in the fund pages (the Funds). In making an investment decision in relation to a Fund, it is important that you read the disclosure document and the target market determination for that Fund. The fund summarises for each Fund refer to the disclosure document (product disclosure statement and any supplementary product disclosure statement) issued for that Fund. The disclosure document and target market determination for each Fund are issued by CFM and are available from www.cromwell.com.au or by calling Cromwell’s Investor Services Team on 1300 268 078. Not all of the funds are open for investment. Applications for units in open Funds can only be made on application forms accompanying the disclosure document for the Fund.

Before making an investment decision, you should consider the disclosure document and the target market determination for the particular Fund and assess, with or without your financial or tax adviser, whether the Fund fits your objectives, financial situation or needs. Past performance is not a reliable indicator of future performance. Forward-looking statements (provided here as a general guide only) and the performance of a Fund are subject to the risks and assumptions set out in its disclosure document. CFM and its related bodies corporate, and their associates, do not receive any remuneration or benefits for the general advice given in these investment updates. If you acquire units in a Fund, CFM, Phoenix and certain related parties may receive fees from the Fund and these fees are disclosed in the disclosure document for that Fund.

Please note: Any investment, including an investment in the Funds, is subject to risk. If a risk eventuates it may result in reduced distributions and/or a loss of some or all of the capital value of your investment. See the disclosure document for examples of key risks. Capital growth, distributions and tax consequences cannot be guaranteed. The performance of each Fund is subject to the risks and assumptions set out in the disclosure document.