Latest news

View latest updates and news here.

Latest news

View latest updates and news here.

Latest news

Our recent webinar explored how advisers can navigate the complexities of listed property—covering diversification, after-tax returns, and the impact of index concentration on performance. Presented by Stuart Cartledge, founder and Managing Director of Phoenix Portfolios, the session offered practical insights into how listed property can complement a balanced investment strategy. The Cromwell Phoenix Property Securities Fund was also discussed as an example of an active, benchmark-unaware approach designed to uncover overlooked opportunities and manage risk. If you’re looking to enhance your client’s portfolio, this session is worth a watch.

Watch the webinar replay.

Earlier this year, Cromwell completed significant upgrades and fitouts at 207 Kent Street, aimed at elevating tenant experience and fostering a vibrant, collaborative work environment. Within four weeks of project completion, the team secured a heads of agreement and welcomed Life Without Barriers, who now occupy one of the newly custom-fitted suites on Level 6.

The plug-and-play design allows tenants to move effortlessly into a space designed to enhance their experience and foster a collaborative, flexible working environment.

For more about our continuous upgrades at 207 Kent Street, read our article on the evolution of the office workspace.

Three years after COVID lockdowns: The evolution of the office workplace – Cromwell Funds Management

Cromwell is pleased to announce our ongoing, active participation in the Property Council of Australia Committees for 2025/26.

We are committed to championing strong advocacy for the property industry, driving positive change, and fostering growth. Together, we will address key challenges and seize opportunities to shape a vibrant and resilient future for the sector.

Cromwell will hold its HY25 financial results on Thursday 27 February 2025. Cromwell invites investors to attend the online briefing, hosted by Chief Executive Officer Jonathan Callaghan and other members of the Cromwell team.

The briefing will commence at 10am AEDT (Sydney/Melbourne).

Pre-register via the Cromwell website:

https://www.cromwellpropertygroup.com/hy25-results

International Women’s Day (IWD) is celebrated globally by millions each year on 8 March to honour the achievements, strength, and contributions of women everywhere. We at Cromwell are committed to creating an inclusive environment where everyone has the chance to thrive. We’re dedicated to championing strong advocacy for the property industry, driving positive change, and fostering growth.

Together, we address key challenges and seize opportunities to shape a vibrant and resilient future for the sector. To acknowledge and celebrate the day, our teams opened discussion about what IWD means, and utilised resources to deepen that understanding. Unfortunately, as a result of Cyclone Alfred, office closures meant we were unable to host our planned morning tea, meaning celebrations were instead held virtually.

We are proud to see IWD celebrated across our assets through use of signage in the lobbies and lifts and communications directly to tenants. We also ran a competition and hosted complimentary massages for tenants. Cromwell’s focus on gender equality has seen us reach key achievements, including a significant reduction in gender pay gap, improved diversity across all levels, paid Domestic Family Violence leave and parental leave for all genders, to name a few.

Together, these efforts reflect our dedication to building a more inclusive and supportive community for everyone at Cromwell.

Cromwell is pleased to inform you that our Brisbane properties were largely unaffected by the recent tropical cyclone. This includes 100 Creek Street and 545 Queen Street in the Cromwell Direct Property Fund and 400 George Street and HQ North in Cromwell’s investment portfolio.

Our integrated property model ensures we can be vigilant with our assets, proactively safeguarding our tenants and buildings and minimising disruptions.

Key points:

- Our technology-enabled assets allowed our facilities management team to remotely monitor properties at the peak of the weather event, ensuring that critical services remained operational.

- The Property Management teams maintained communication over the weekend with our tenants, reassuring them that our assets were functioning normally. This proactive approach facilitated a seamless return to work on the Monday following the event.

- Our Facilities Management teams were well-prepared, leveraging strong industry relationships to pre-emptively engage contractors for any necessary rectification work. Fortunately, this was not required.

- While there was some façade damage to 545 Queen Street due to airborne debris, operations were unaffected. The damage will be addressed through insurance.

We extend our gratitude to our dedicated teams and partners for their exceptional efforts during this challenging time.

As the Cromwell Phoenix Global Opportunities Fund celebrated its five-year anniversary, Cromwell Funds Management and the fund’s Investment Manager Phoenix Portfolios recently hosted a webinar to provide insights into the fund’s journey and performance.

During the session, Portfolio Manager Jordan Lipson discussed the fund’s investment strategy, market opportunities, and outlook. By focusing on small, often overlooked global equities, the fund has delivered an annualised return of 13.5%1, outperforming market benchmarks through expert insights and strategic investments across diverse global sectors. Thank you to everyone who attended the webinar.

For more information about the Cromwell Phoenix Global Opportunities Fund, please visit cromwell.com.au/gof or contact Cromwell’s Investor Services Team at 1300 268 078.

- As at 31 December 2024, after fees and costs. Past performance is not a reliable indicator of future performance.

Cromwell is pleased to announce our ongoing, active participation in the Property Council of Australia Committees for 2025/26.

We are committed to championing strong advocacy for the property industry, driving positive change, and fostering growth. Together, we will address key challenges and seize opportunities to shape a vibrant and resilient future for the sector.

Although the thought of warmth might not be appealing right now, given the recent scorching temperatures in Brisbane, we are pleased to announce the completion of our heating upgrade at 100 Creek Street. Tenants can look forward to a cozy and comfortable environment this winter.

This upgrade follows our recent lift modernisation at 100 Creek Street. The new motors offer impressive energy savings of 55% compared to the older ones and regenerate 35% of the power used, feeding it back into the building grid. This initiative not only provides significant environmental benefits but also helps reduce energy costs, which is especially important with rising energy prices.

Cromwell will hold its HY25 financial results on Thursday 27 February 2025. Cromwell invites investors to attend the online briefing, hosted by Chief Executive Officer Jonathan Callaghan and other members of the Cromwell team.

Cromwell will hold its HY25 financial results on Thursday 27 February 2025. Cromwell invites investors to attend the online briefing, hosted by Chief Executive Officer Jonathan Callaghan and other members of the Cromwell team.

The briefing will commence at 10am AEDT (Sydney/Melbourne).

Pre-register via the Cromwell website:

https://www.cromwellpropertygroup.com/hy25-results

Unitholders have recently voted to approve a Term Extension Proposal for the Cromwell Riverpark Trust.

Of the 69.69% of unitholders who voted, 88.01% were in favour of extending the Term until 31 December 2026 to allow Energex House to be sold in a more orderly market.

The decision by Cromwell Riverpark Trust Unitholders to extend the term reflects a strategic approach to navigating current market challenges. By allowing more time for market conditions to stabilise and improve, the Trust aims to achieve a more favourable sale price for Energex House. The strong fundamentals of the Brisbane office market, combined with early signs of price stabilisation and potential future decreases in interest rates, support this decision wait, rather than sell into a depressed market.

Cromwell Funds Management remains committed to monitoring the market and will initiate a formal sale campaign when conditions are deemed favourable, aiming to ensure the best possible outcome for unitholders.

We are proud to announce that Cromwell Property Group, as a member of the Champions of Change Coalition, joined the global movement to end violence against women and girls by participating in UN Women Australia’s Safe. Everywhere. Always. campaign.

During the 16 Days of Activism Against Gender-Based Violence (25 November – 10 December), we raised awareness across our assets and hosted the ‘Tools Down’ webinar for tenants, organised by the Property Council of Australia.

This is a national crisis, and we all have a role to play in ending it. The Safe.Everywhere.Always campaign calls for a world where women and girls can live without fear – whether at home, in the workplace, or online. Safety is a non-negotiable human right.

We are pleased to announce that Cromwell has been awarded the Best Sustainable Finance Deal for Australia/New Zealand 2024 by FinanceAsia.

FinanceAsia’s annual Achievement Awards celebrate excellence across Asia’s financial markets, recognising the outstanding achievements of key players in the Asia Pacific and the Middle East. This prestigious award highlights Cromwell’s dedication to sustainability and innovation in finance.

Cromwell won the award for our multi-bank, $1.2 billion Green and Sustainably Linked Loan, which is uniquely aligned with both the Asia Pacific Loan Market Association Green Loan Principles and Sustainability Linked Loan Principles. The loan includes ambitious targets to reduce emissions and our gender pay gap, underscoring our commitment to these critical issues as part of our broader environmental, social, and governance policy.

Read more about Cromwell’s Sustainably Linked Loan click here Cromwell links new loan facility to emissions reduction, gender pay gap targets – Cromwell Property Group.

Read FinanceAsia’s release here: https://www.financeasia.com/article/financeasia-achievement-awards-2024-apacs-best-deals-revealed/499411

As part of Cromwell’s commitment to providing exceptional experiences for tenant-customers across the assets, we have partnered with two organisations to support communities this Christmas.

Cromwell is proud to support the Children’s Hospital Foundation for the ‘A Wish for Christmas’ initiative. Christmas trees adorned with gift tags have been set up across four of our Brisbane assets. Those wishing to donate can make a $5 contribution to the Foundation, receive a gift tag, and write a heartfelt message of support to sick children across Queensland.

In addition, we have established donation bins for the Salvation Army Christmas Appeal for our NSW, VIC and SA assets. Tenants are encouraged to donate items such as food, children’s toys, gift cards, and more, which will be distributed to families in need during the holiday season. This initiative aims to bring joy and support to those who need it most during Christmas.

The results of Cromwell’s annual tenant satisfaction survey have been compiled for FY25 – and the feedback has been encouraging.

Future Forma – an agency specialising in the independent evaluation of tenant–customer experiences across individual assets and portfolios – was engaged by Cromwell in August to conduct annual surveys across our commercial assets.

Across the portfolio, Cromwell achieved an overall tenant satisfaction score of 89%. This is a 1.4% increase on last year’s score, and is 8.9% higher than the Tenant Satisfaction Index – which comprises of 350+ investment grade office building surveys throughout Australia.

Data contained in the Future Forma report will allow us to focus on the continuous improvement of our tenant’s workplace experience and create greater efficiencies in the business’s processes.

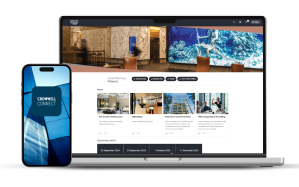

Cromwell Property Group has officially launched a new tenant engagement platform at two of its buildings, ahead of extending the rollout to another four buildings from early 2025.

Named CromwellConnect, the online portal and smartphone app has been specifically designed to enhance the tenant experience at select Cromwell office buildings. The platform provides tenants with relevant information, tools, and services to make their respective workdays a more engaged, tailored, and efficient experience.

Through CromwellConnect, tenants can find information on the surrounding CBDs and important services; end-of-trip and third space facilities access; lunch specials at local eateries; information on the exciting events being held inside and outside of the building; and so much more.

The platform was successfully rolled out at our 100 Creek Street building in Brisbane in late September, and is currently being rolled out at our 207 Kent Street Building in Sydney. The collective tenant response to the new platform has been extremely positive.

The Cromwell Phoenix Property Securities Fund (PSF) has retained its ‘Highly Recommended’ rating from leading Australian investment research house, Zenith Investment Partners.

This achievement recognises the extensive experience and investment skills of the combined Cromwell Funds Management team alongside Stuart Cartledge of Phoenix Portfolios, the Fund’s investment manager.

The Cromwell Phoenix Property Securities Fund, with the expertise of Phoenix Portfolios, has earned multiple awards for its performance as one of the top property securities funds in Australia, including the Zenith Investment Partners’ Australian Real Estate Investment Trust Award 2022 for excellence in funds management.

The Fund offers investors exposure to a diverse portfolio of property securities that possess an understandable business model, good governance and are trading below Phoenix’s assessment of intrinsic value.

Find out more about the Cromwll Phoenix Property Securities Fund here.

Again, this year, Cromwell joined with people across the country to celebrate National NAIDOC Week, from 7-14 July.

NAIDOC Week is a time to recognise and celebrate the history, culture, and achievements of Australian Aboriginal and Torres Strait Islander peoples.

This year’s theme – Keep the Fire Burning! Blak, Loud and Proud – called for a reclamation of narratives, an amplification of voices, and an unwavering commitment to justice and equality.

All Australians were invited to listen, learn, and engage in meaningful dialogue; to foster a society where the wisdom and contributions of Indigenous peoples are fully valued and respected.

To mark the occasion, Cromwell engaged Melbourne-based, Indigenous-owned business Kinya Lerrk to design a vibrant lift installation for some of our buildings nation-wide. Visual artists Emma Bamblett and Megan Van Den Berg created a piece called NAIDOC: A celebration of Aboriginal Culture, which represents the journey of firesticks and how they represent the shared learning and strengths of Indigenous Australian communities.

As part of our commitment to diversity, equity, and inclusion – including subjects that uniquely affect Indigenous Australians – Cromwell will continue to collaborate with key voices on these topics, both within and outside our organisation.

Cromwell remains committed in our continued support of Indigenous-owned businesses, as well as the creation of a sustainable Indigenous business sector, as we continue our journey towards the development of our first Reflect Reconciliation Action Plan.

Cromwell is pleased to announce that our Client Services Officer, Audrey Lovi, and Senior Property Manager, Karla Bowdler, have both been named in the Property Council of Australia’s ‘500 Women in Property’ initiative for 2025.

Now in its ninth year, this PCA programme aims to accelerate more women into leadership positions in the property industry, through sponsorship of high-potential talent.

The programme involves a personal commitment from sponsors to identify and champion women in their organisation or network who would benefit from the exposure and professional development opportunities.

This year, Ms Bowdler will be sponsored by our Head of Treasury, Stephanie Finemore, and Ms Lovi will be sponsored by our Operations Manager – Retail Funds Management, Marita Sweeney.

Both Cromwell representatives will be joining the more than 3,600 women that have participated since the programme’s inception in 2016.

In early June, Cromwell completed the conversion of a multi-bank, $1.2 billion lending facility to a sustainability linked loan that includes ambitious targets in reducing emissions and our gender pay gap. Central to the new loan structure is:

- Greenhouse gas reductions, in line with Cromwell’s target for net zero scope 3 emissions by 2045, to reinforce the company’s position as an industry leader in reducing scope 3 emissions.

- Additional targets linked to our target of net zero scope 1 and 2 emissions by 2035.

- To reduce our gender pay gap to a maximum of 12% by 2028. This target forms part of Cromwell’s broader diversity commitments, which include maintaining pay parity across all roles, and maintaining 40:40:20 gender targets across all leadership levels within the organisation.

Cromwell’s Group Head of ESG, Lara Young, said that the new sustainability linked loan has created an opportunity to highlight the business’s focus on several critical topics, as part of its broader environmental, sustainability, and governance policy.

“We have been working with tenants and suppliers across all our upstream and downstream business activities – covering our entire supply chain of tenant activities; funds under management; joint ventures; and embodied carbon sources – to stretch our net zero approach beyond our operational control,” said Ms. Young.

“The progression we have made in this space has allowed us to set our most ambitious target to date, as part of this new sustainability linked loan – to reduce scope 3 greenhouse gas emissions intensity to equal, or less than, 30.16 (kgCO2e/m2) by 2028.”

“Importantly, by leveraging sustainability linked debt at the same time as meeting important social milestones, Cromwell Property Group can move significantly closer to meeting our current and future ESG responsibilities, including a Cromwell portfolio Net Zero Scope 1 and 2 target by 2035.”

In-mid May, Cromwell announced the sale of six retail centres across Poland, held by the Cromwell Polish Retail Fund for €285 million / $465 million, which is in line with asset valuations announced at HY24 results.

The purchaser, Star Capital Finance, is a diverse real estate investor based in Prague, Czechia.

This follows the sale of Cromwell’s 50% share of its joint venture retail asset in Ursynów, Poland, which completed on 29 February 2024, to joint venture partner Unibail Rodamco for €41.5 million / $69 million.

These transactions are a crucial step in the Group’s continued simplification through the sale of non-core assets to de-risk the business, reduce gearing and realign to Cromwell’s core fund and asset management capabilities.

Full story here.

On 23 May, Cromwell announced that the business has entered into a binding agreement for the sale of Cromwell’s European fund management platform and associated co-investments for a total consideration of €280 million/$457 million to Geneva-headquartered Stoneweg SA Group.

Stoneweg is multi-strategy real estate investment manager with over €4.0 billion of assets under management.

The Transaction covers all components of Cromwell’s European business, excluding the Cromwell Polish Retail Fund assets, which were subject to a separate sale process, which completed on 15 May 2024 in Europe.

The sale of our European assets is consistent with the Group’s commitment to simplify the business to transition to a capital-light funds management model. The exit from the European business allows Cromwell to focus on its core competencies in Australia and New Zealand – and positions the platform for future growth.

Full story here.

The NABERS Sustainable Portfolio Index (SPI) results have been released for 2024 – and Cromwell has again achieved a top five position for both the Cromwell Direct Property Fund and Cromwell’s investment portfolio.

Cromwell’s Direct Property Fund

- Cromwell’s Direct Property Fund (DPF) ranked fifth spot in the ‘Offices and Shopping Centres’ category for 2024 and was awarded a 5.3 portfolio energy rating by NABERS.

Cromwell’s investment portfolio

- Cromwell’s investment portfolio has been awarded the fourth spot in the ‘Offices and Shopping Centres’ category for 2024 with a 5.4 portfolio energy rating by NABERS.

This result reaffirms Cromwell’s continued commitment to sustainability across our business, and we commend everyone in the business who helped achieve this impressive result.

Now in its sixth year, the SPI includes 60 office and shopping centre portfolios, as well as covering public hospitals for the first time, with 133 Victoria Health assets included.

The index offers a unique, whole-of-portfolio view of actual performance across energy efficiency, water efficiency, waste management, indoor environment quality, and carbon neutrality.

For years, Cromwell’s Insight magazine has been one of the commercial property sector’s premier publications – a regular way for us to connect with you, our investors. We continue to endeavour to bring you the most relevant, engaging, and insightful content in each edition.

We’re conscious of the current challenging economic environment – and the need to reduce spend and minimise waste – while still delivering Insight to our eager readers.

As such, we have begun to roll-out a new way of getting news to you – a monthly digital version of Insight, straight to your email inbox. If you would like to receive news articles and commentaries each month via email, and you aren’t already, complete the form online here: www.cromwell.com.au/opt-in

Cromwell Funds Management’s latest property investment opportunity, the Cromwell Healthcare Property Fund, is launching soon.

Cromwell’s newest fund, The Cromwell Healthcare Fund, is expected to officially launch in May 2024, with eager investors already registering their interest.

The new Fund aims to provide investors with an average distribution yield over 7% per annum, paid monthly and is targeting an investment term of 5 to 7 years. The Fund replicates many features of Cromwell’s other single-asset unlisted property trusts, including a strong tenant profile and long lease term.

Key characteristics:

- South Australian Government healthcare operator on long-term lease

- Essential health service provider for outpatient, primary, and allied health

- Facility alleviates pressure on nearby hospitals

For more information about the new fund, the product flyer, and the PDS and TMD, visit www.cromwell.com.au/invest/latest-investment-opportunities/cromwell-healthcare-property-fund.

Cromwell’s 700 Collins Street property in Melbourne has achieved a WiredScore Platinum rating.

WiredScore certification is the global standard for digital connectivity, which recognises and promotes best-in-class digitally connected buildings across the globe.

WiredScore’s Collins Street rating signifies that the building offers premium connectivity and cutting-edge technology, which seeks to ensure an exceptional experience for our occupiers.

By providing users with multiple choices of internet service providers, a reliable mobile experience, and infrastructural safeguards to maintain secure connectivity, 700 Collins caters to a wide range of connectivity requirements, and meets the daily digital needs of our tenants.

Congratulations to Cromwell’s property team for maintaining such an exciting asset!

Download the latest edition

All the latest articles and news in one handy download.