Outlook

The Australian economy remains robust, despite headwinds. Employment is solid – with unemployment hovering around 3.5%, while job vacancies remain particularly high. Economic growth maintains positive momentum dominated by export demand for resources.

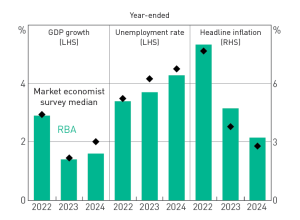

The RBA expects some of this to continue – with the unemployment rate to remain around 3.5% in 2023, weakening to 4.5% in 2024. While it expects inflation to peak at around 8% in 2022 (dominated by higher food prices & energy), it expects it to gradually move down to ~3% by 2024 year-end. Economic growth will slow (we expect to around 2% in 2023), but still remain positive and impressive compared to other western countries.

These factors along with business conditions at a healthy ~30 year high1 put the Australian economy and commercial property market in good stead. Businesses continue to adjust size requirements for occupancy as they live with hybrid working, although in certain markets this is now largely known.

Experiential workplaces with clever refurbishments and amenity continue to attract and retain quality tenants; something we continue to see within our assets.

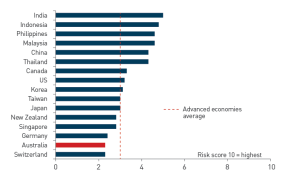

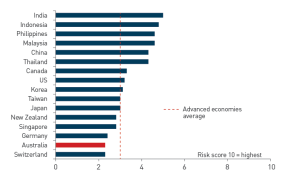

In a global context, Australia is in a position of strength, with a compelling economic outlook, comparatively low inflation compared to Europe and the US and an attractive demographic profile. Oxford Economics, therefore, estimate Australia’s economic risk to be one of the lowest of the advanced economies.

This should in turn support tenant demand for good quality real estate to facilitate economic growth and cater for a growing and ageing population. Liquidity from both domestic and international capital is likely to improve. In conjunction, powerful megatrends such as the need for more sustainable, energy efficient real estate and rising demand for segments serving the modern economy such as urban logistics, data centres and highly amenitised offices will create income growth opportunities.

| Figure 4: RBA and Market Economist Forecasts |

Figure 5: Economic risk: Australia vs advanced economies average |

|

|

| Source: ABS; RBA |

Source: ABS; RBA |

How did Cromwell Funds Management fare this quarter?

The Cromwell Direct Property Fund sold Allara Street, Canberra, this quarter. The property was originally bought in July 2015 for $16.8m and was sold in October 2022 for $18.187m. Sales proceeds were used to reduce debt. Gearing as at 31 December 2022 was 36.3%. Further leasing success post 31 December at Queen St Brisbane, Creek St Brisbane, and Grenfell St Adelaide will improve the current 93.6% occupancy rate and 4.6-year WALE.

The Fund currently distributes 6.75 cents per unit p.a., or 5.29%2, payable monthly, and has generated annualised total returns since inception of 8.8% p.a. The Cromwell Direct Property Fund continues to demonstrate excellent risk adjusted returns for investor portfolios.

Performance (%) P.A as At 31 December 2022

| Year |

Cash (AU) |

Bonds (AU) |

Shares (AU) |

Cromwell Direct Property Fund |

| 1 |

1.25% |

(9.71%) |

(1.77%) |

0.7% |

| 3 |

0.55% |

(2.87%) |

5.51% |

6.1% |

| 5 |

1.01% |

0.54% |

7.10% |

6.8% |

Source: Lonsec and Cromwell Funds Management

Footnotes