An opportunity underpinned by location: why the Cromwell Healthcare Property Fund

Colin Mackay, Research and Investment Strategy Manager, Cromwell Property Group

As a property segment, medical centres have all the right ingredients to provide a compelling investment opportunity – industry-wide structural tailwinds, strong fundamentals resilient to economic cycles, alignment to government funding, and attractive investment characteristics. But like any real estate investment, location matters. In this short article, we’ll outline some of the factors that make the Cromwell Healthcare Property Fund (Fund) stand out, with its proposed acquisition of 16 Playford Boulevard, Elizabeth, South Australia (the Property).

Catchment characteristics

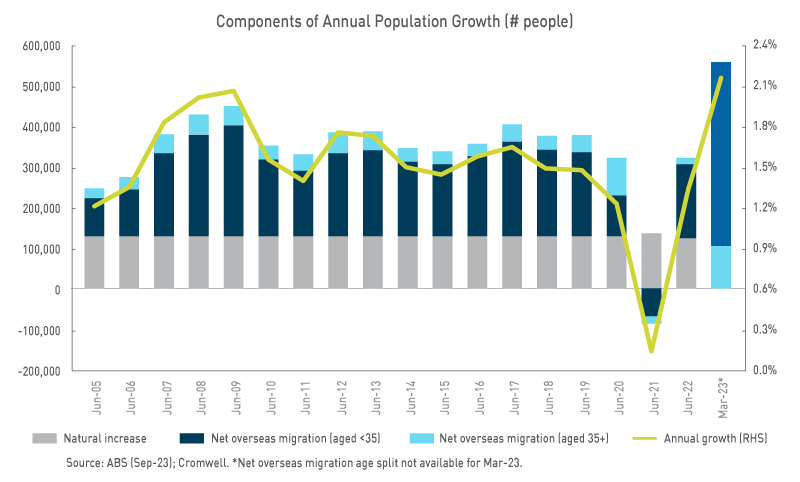

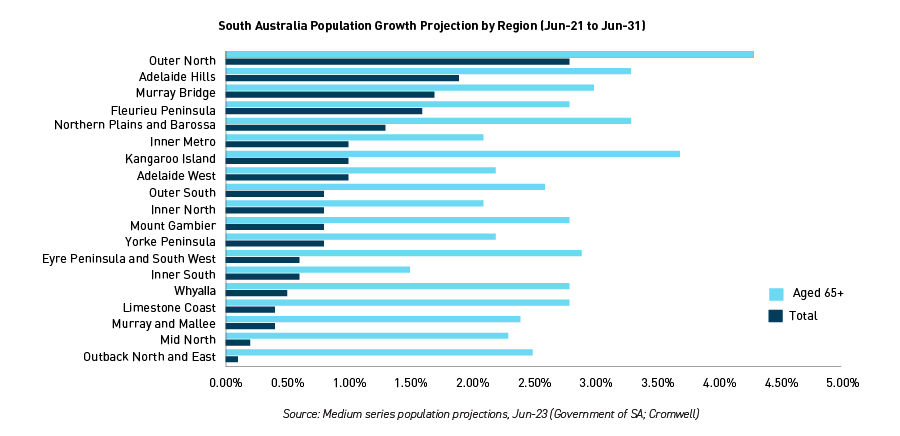

Demand for healthcare is closely linked to population growth, particularly amongst those aged over 65. The Property is located in the fastest growing region in South Australia (Outer North), with total population growth of 2.8% p.a. projected from 2021-31, and growth in the 65+ segment projected to be even more significant (4.3% p.a.). At a more granular level, the Local Government Area (LGA) in which the Property is located (Playford), is projected to see the third strongest population growth over the period, at 2.9% p.a.1

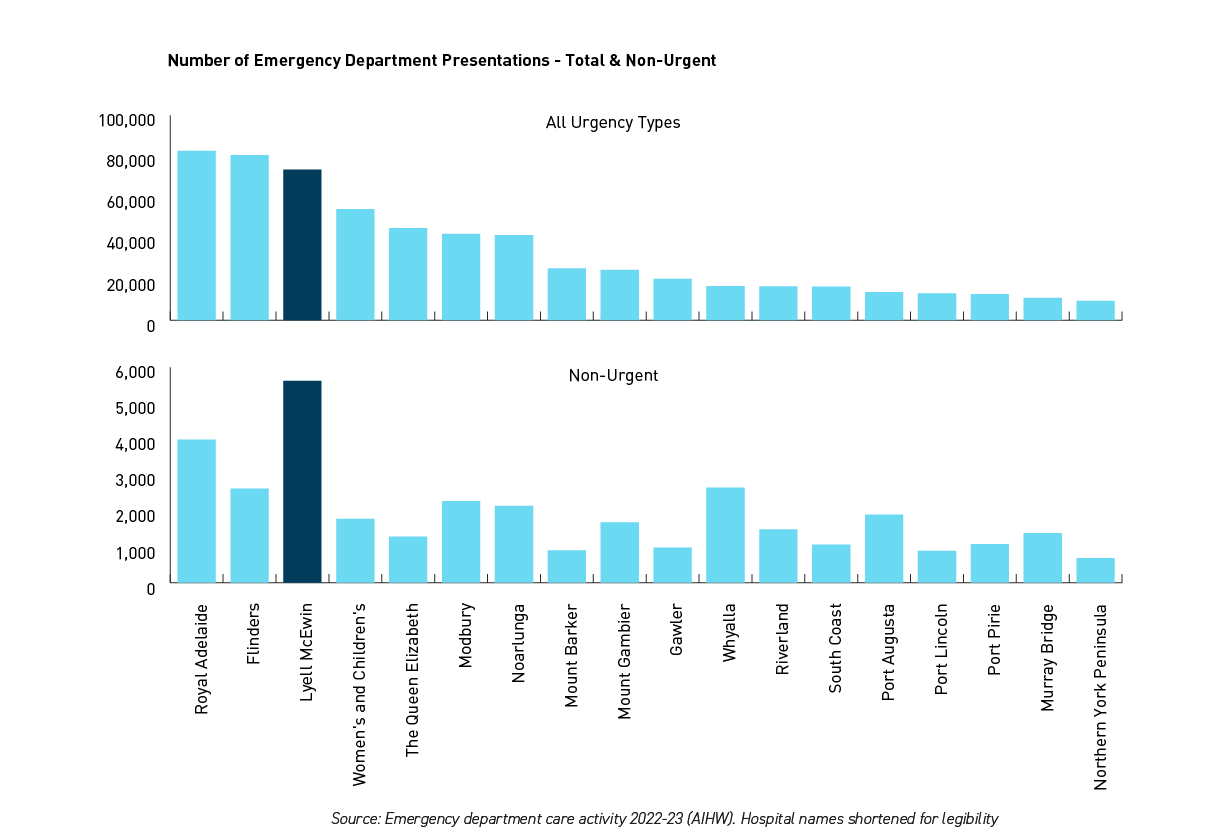

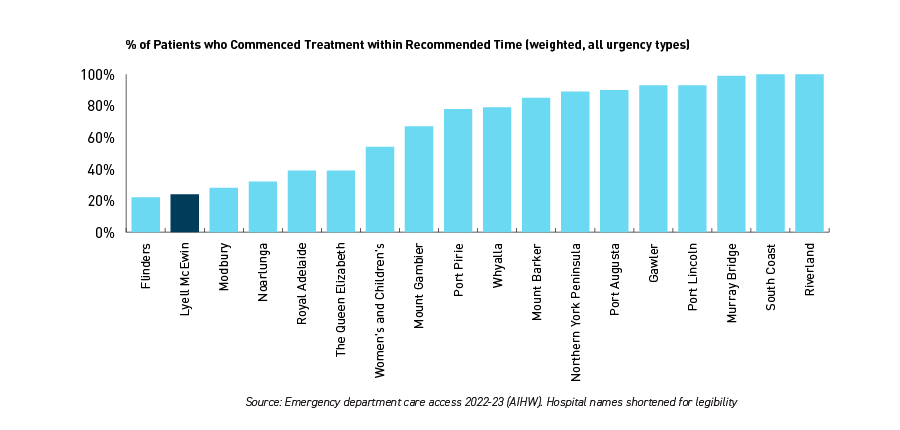

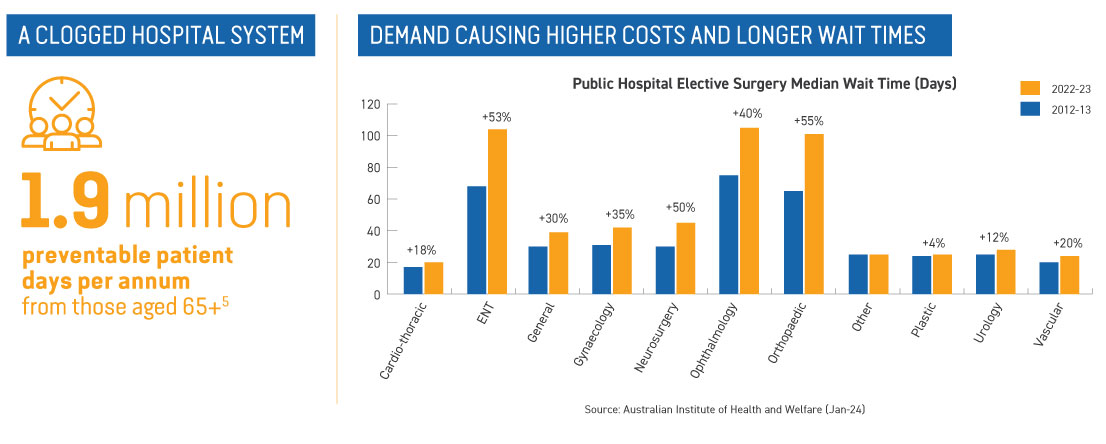

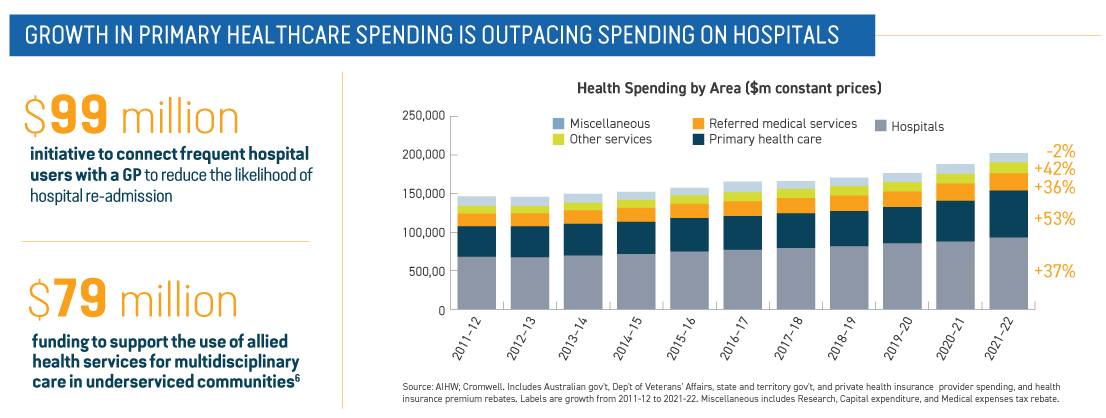

Low socioeconomic status is linked to higher incidence of disease and greater need for care. Due to cost, those with more socioeconomic disadvantage have lower rates of private health coverage2. They are also less likely to see a health practitioner but more likely to visit an emergency department2, resulting in a greater number of avoidable hospital presentations which unnecessarily take up valuable resources. The Property is located in the fourth most disadvantaged LGA in South Australia (out of 71) and the lowest socioeconomic LGA within metropolitan South Australia3, which Cromwell believes indicates significant demand within the catchment for affordable, public-aligned healthcare services, such as those provided at the Property.

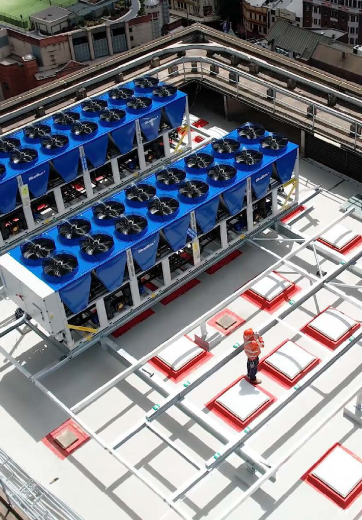

Cromwell has completed Stage 2 of our programme of works to install solar panels on buildings at locations across the country, as part of the business’s commitment to meet our long-term ESG targets.

Cromwell has completed Stage 2 of our programme of works to install solar panels on buildings at locations across the country, as part of the business’s commitment to meet our long-term ESG targets.

About Stuart Cartledge

About Stuart Cartledge