September 2024 direct property market update

Economy1

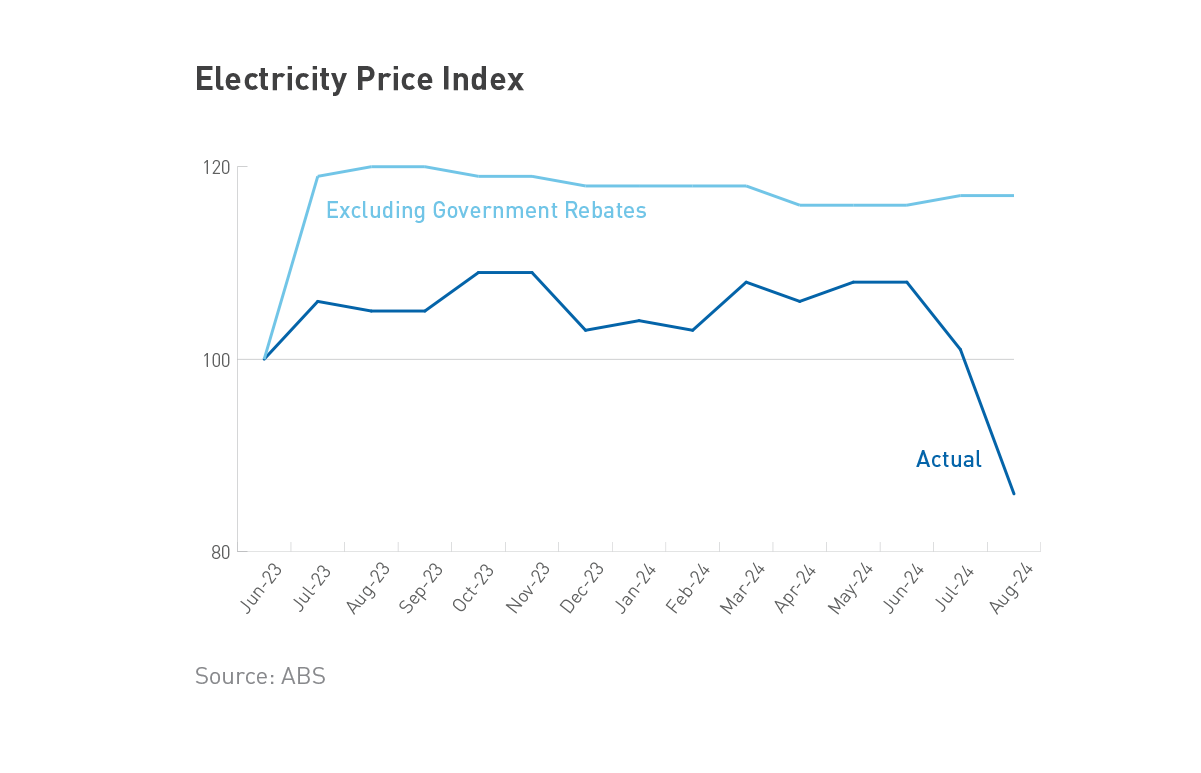

The trajectory of inflation – and consequently interest rates – remains top of mind for financial markets, businesses, and households alike. Year-on-year headline inflation of 2.7% was recorded in the month of August, a substantial fall from the 3.5% rise recorded in July and the first time the measure has sat within the RBA’s target band of 2-3% since 2021. However, the sharp fall was in part due to Federal and State Government cost-of-living subsidies, namely electricity rebates. The RBA is “looking through” these temporary factors and instead focusing on underlying inflation, which continued to slow in August but was a more elevated 3.4% year-on-year (per the trimmed mean).

The RBA has maintained its cautious stance, making it clear that its focus is on getting inflation sustainably within the target range. Any decisions to cut the official cash rate will be made with that objective top-of-mind. While some banks are still noting the possibility of a rate cut at one of the two remaining meetings this year, consensus points to the first cut occurring in February next year, with several cuts expected by December 2025 . Lower interest rates should boost market confidence, stimulate transaction activity, and support property prices.

One of the key data points influencing the RBA’s monetary policy decisions – besides inflation – is the strength of the labour market. Employment has proven resilient, with jobs growth of 47,500 recorded in August. Similarly, the unemployment rate remained at 4.2%, having only increased by +0.3% since the start of the year. While these and other metrics indicate a robust labour market, it is important to highlight that not all industries are experiencing the same conditions. One of the more obvious divergences exists between industries exposed to the business cycle and consumers (market industries), and non-market industries such as healthcare and education. Data released in September indicates non-market industries accounted for 89% of jobs created over the 12 months to June. This poses a challenge for the RBA, which would like to see some heat come out of the labour market overall, but whose blunt tool has more of an impact on the industries and sectors which have already slowed.

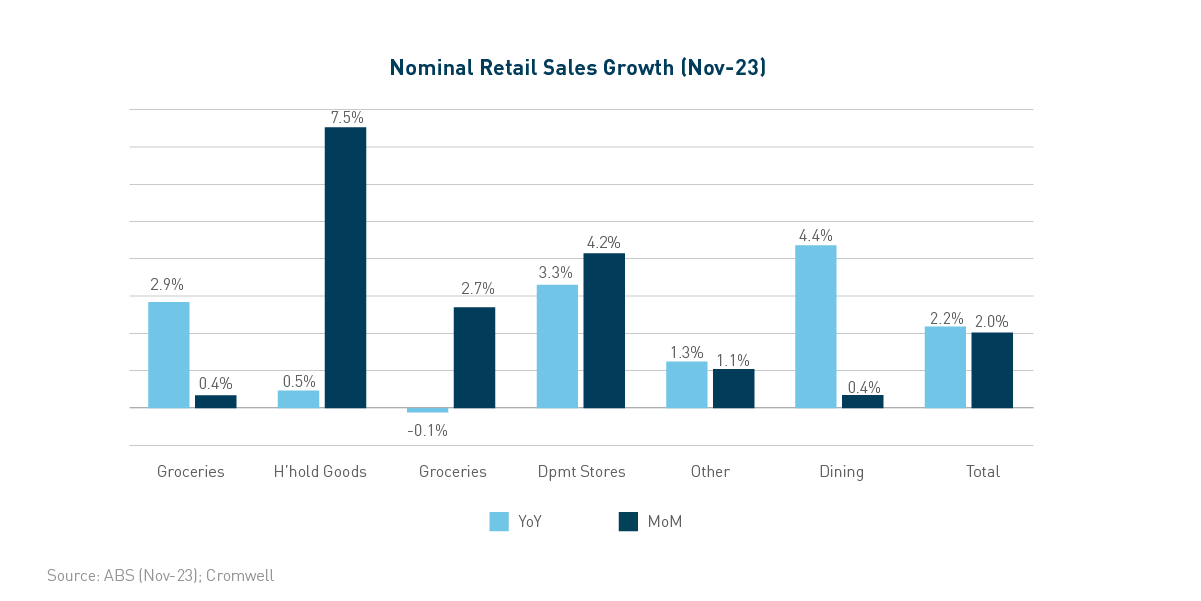

Another important driver of the economy being closely watched is household consumption and how it responds to the stage 3 tax cuts which kicked in this quarter. While it’s too early to get a firm read on consumers’ response, initial indications suggest a greater propensity to save than spend. CommBank’s analysis of their proprietary data shows while incomes have increased following the tax cuts, card spending has not seen a similar lift. Instead, consumers are saving the additional cash flow by boosting offset and redraw account balances. The CommBank data was broadly corroborated by the ABS Household Spending Indicator for August, which showed spending -0.5% lower than June levels. While the retail component of household consumption exceeded expectations in August (+3.1% YoY) and should be supported by the tax cuts, a sustained recovery may take some time (and rate cuts) to materialise.

Cromwell’s Investment Manager, Lachlan Stewart, is an experienced commercial real estate professional, who has spent more than 20 years working for highly respected organisations, including Colliers International and GE Capital Real Estate. He specialises in property valuations and financial modelling.

Cromwell’s Investment Manager, Lachlan Stewart, is an experienced commercial real estate professional, who has spent more than 20 years working for highly respected organisations, including Colliers International and GE Capital Real Estate. He specialises in property valuations and financial modelling.

About Stuart Cartledge

About Stuart Cartledge