Housing demand

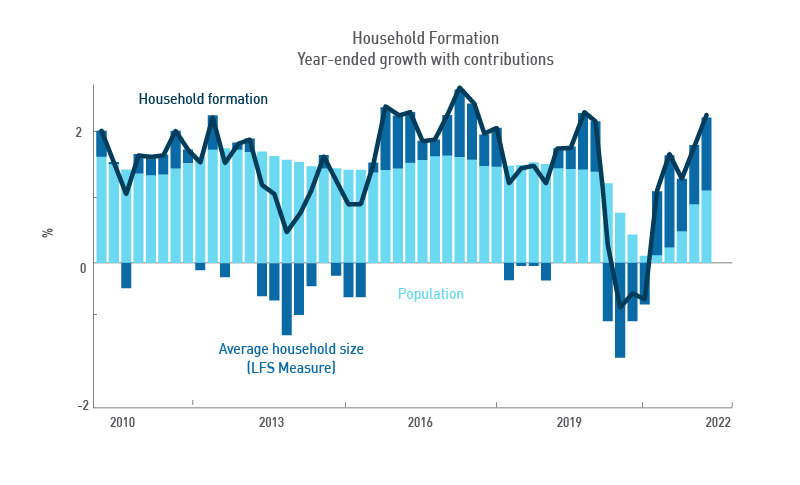

In the most basic sense, the quantum of dwellings needed in Australia is related to the amount of people in each dwelling and the population of the country. The Australian Bureau of Statistics (ABS) and Reserve Bank of Australia (RBA) have compiled the nation’s historic average household size and recent trends as shown below:

While perhaps a controversial figure, former RBA Governor Phillip Lowe summed up recent changes astutely, saying:

“During the pandemic, the average number of people living in each household declined. People wanted more space. They were working from home. Rents actually declined for a while. People said, ‘Rather than have a flatmate I will just have an office at home,’ so the average number of people living in each dwelling declined and that increased the demand as a result for the total number of dwellings”.

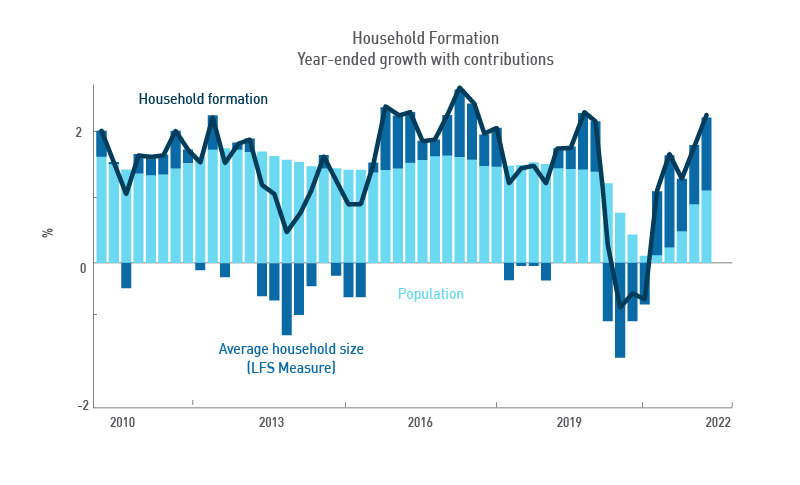

So, we have less people living in each dwelling and the other component of household requirements, populaion, is also increasing strongly. Again, the RBA and ABS help by showing both the impact of population growth (in light blue) and change in household size (dark blue) over time in the chart below:

Again, Phillip Lowe sums up the situation:

“The other thing that is now happening is a big increase in population. The population is increasing by two per cent this year. Are there two per cent more houses? No. The rate of addition to the housing stock is very low. We have a lot of people coming into the country.”

This comment touches on the other key element to home prices in Australia. Namely, the supply of new property.

The other thing that is now happening is a big increase in population. The population is increasing by two per cent this year. Are there two per cent more houses? No. The rate of addition to the housing stock is very low. We have a lot of people coming into the country.

Phillip Lowe