Tax-deferred distributions occur when a fund’s cash distributable income is higher than its net taxable income. This difference arises due to the trust’s ability to claim tax deductions for certain items – such as tax decline in value on plant and equipment; capital allowances on the building structure; interest and costs during construction or refurbishment periods; and the tax amortisation of the costs of raising equity.

In tax technical terms, tax-deferred amounts can give rise to distributions from property trusts of “other non-attributable amounts” for trusts that have elected to be Attribution Managed Investment Trusts (AMITs) and “tax deferred” components in non-AMITs – all referred to as tax-deferred distributions in this article.

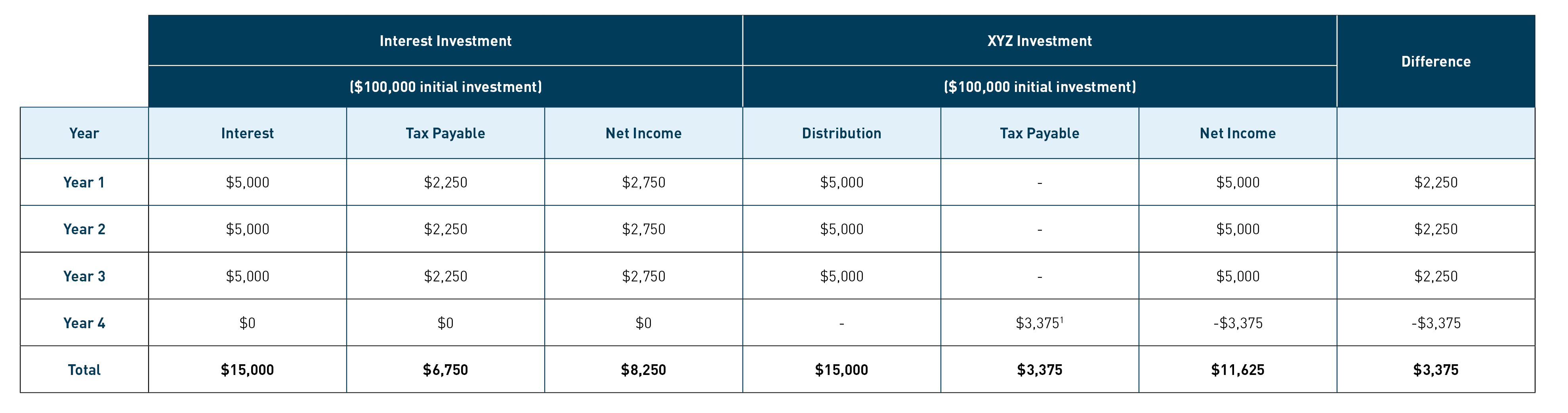

Tax-deferred distributions are generally non-taxable when received by investors. Instead, these amounts are applied as a reduction to the tax cost base of the investor’s investment in the property fund, which is relevant when calculating any Capital Gains Tax (CGT) liability upon disposal of the investment units or once the tax cost base has been reduced to nil. Therefore, any tax liability in relation to these amounts is ‘deferred’, typically until the sale or redemption of an investor’s units in the fund when CGT may arise.

At its simplest, tax deferral works as follows: suppose a trust earns rental income of $100 and has building allowance deductions of $20. Then the net taxable income is $80, which is distributed to unitholders to be included in their taxable income. The remaining $20 of cash is distributed to the unitholders too, but for tax purposes it is regarded as a reduction in cost base of the units invested in the fund by the unitholder.

So long as the accumulated tax-deferred income is less than the investor’s acquisition cost, the tax is generally able to be deferred. If tax-deferred amounts have reduced the cost base to zero – that is, if the investor has received total tax-deferred distributions at least equal to the original cost of the investment – then any excess must be declared as a capital gain in the year it is received.

Capital gains are distributed by a trust only when the trust sells capital assets at a tax profit. These gains are then subject to tax in the investor’s hands, the same as other gains. Alternatively, investors are taxed on any capital gains, including any accumulated tax-deferred distributions, when they dispose of their units in a trust or the trust is wound up.